The NZD/CHF pair is one that a lot of people don't pay attention to, which I believe is truly unfortunate. This is one of those pairs that is so lopsided in one direction that it makes a great tertiary indicator. I say this because the New Zealand dollar is a "risk on" currency, while the Swiss franc is a "risk off" currency. In other words, when the markets are strong in general, this pair goes higher, and falls when people were concerned about economic growth globally. In fact, this pair has very little to do with these two particular currencies most of the time, rather the general attitude of participants in the global markets.

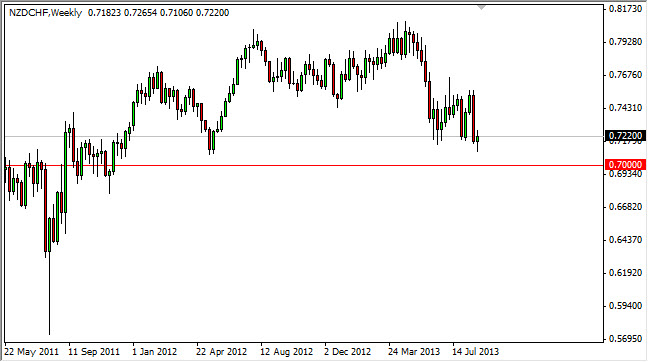

That being the case, looking at this chart I can see that the 0.70 level is significant support zone. On top of that, as you look at the chart you can see that we are trying to consolidate in this general vicinity, which we currently see as 0.72 or so. I believe that this pair will be supportive, and that every time it dips traders will come in to start buying.

Headline risks, and other such nonsense.

Unfortunately, a "risk on, risk off" type of currency pair is very susceptible to headline risks that are found around the world. After all, there at the time of this writing is a considerable amount of concern about the NATO powers doing something in Syria, which has a lot of the trading community jittery. At the end of the day though, it will not affect commerce in either Switzerland or New Zealand. Or for that matter, anywhere else beyond Syria!

That's why I think that any knee-jerk reaction will be thought of in the end. On top of the 0.70 level being supportive, I think the area extends quite a bit lower than that, so I will be looking for supportive candles in general as we trade through the month of September. I believe that if we can get above the 0.75 handle, this market will absolutely check out to the upside. I see far too much support below to even think about selling.