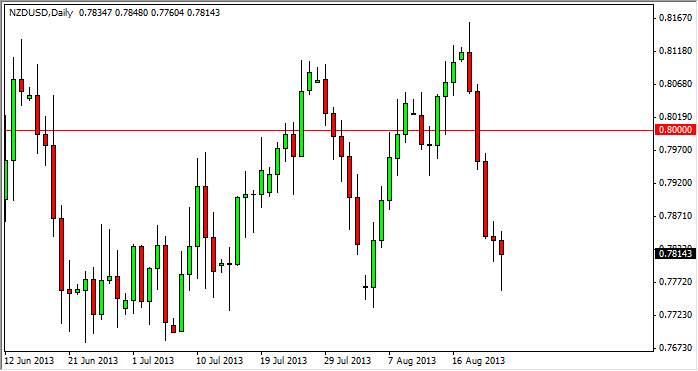

The NZD/USD pair fell during the balance of the session on Friday as you can see, but we also found quite a bit of support at the 0.77 handle, which of course signifies that the market has quite a bit of support below. The support was so significant that we bounced in order to form a nice looking hammer, and I now believe that we are going to go higher simply because we are in a range that has been going on for the entirety of the summer.

This makes sense of course, because of the questions regarding the Federal Reserve and its quantitative easing program, commodities are being thrown around back and forth. Obviously, if you been trading the Forex markets for any length of time you know that the New Zealand dollar is highly leveraged to the commodity sector, so it makes sense that the New Zealand dollar would suffer the same fate as commodities, and other words simply be thrown around.

Watch the soft commodities

While it is all about the Federal Reserve at the moment, the New Zealand dollar tends to be affected more by soft commodities such as grains and meats. This is because they are the grocery store if you will for the Far East. Most of New Zealand economy is based upon agricultural exports, so it makes sense that as agricultural products go, so does the New Zealand dollar.

I don't know what's going to happen in the end, but I do think that a break of the top of the hammer from the Friday session is a good sign that we are heading higher. I think that the market could go size 0.81, but I would probably be quicker to take profits. In fact, I might even choose to take profits at the 0.80 handle in order just to be safe. After all, this is the summertime, and the liquidity is going to be a bit then. Also, you have to keep in mind that the New Zealand dollar is a little less liquid than some of the other more common pairs, so having said that it will be especially affected by summer time trading.