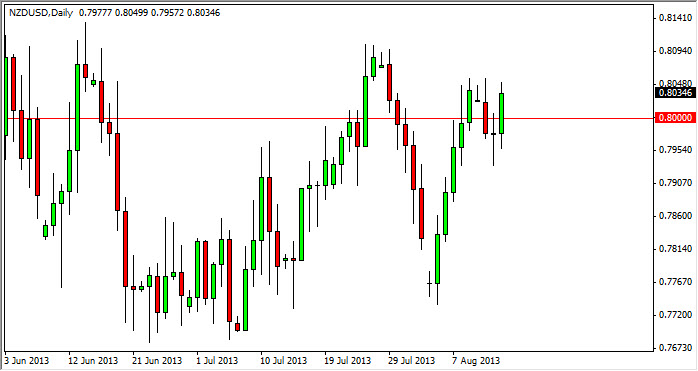

The NZD/USD pair rose during the session on Wednesday, breaking the top of the hammer from the Tuesday session, which is typically a nice buy signal. However, I see that the 0.80 level has been a magnet for price recently, so we are still consolidating as far as I can tell. On top of that, I see quite a bit of noise all the way up to the 0.82 handle it keeps me from buying this pair.

Let's be honest here, it's the Federal Reserve that's pushing the US dollar around at the moment, or perhaps just the expectations what they may or may not do. The New Zealand dollar of course is highly influenced by commodities, and as a result it's difficult to imagine that this currency will go much higher. It's not that it couldn't, it's just that the world is still concerned about the Federal Reserve and what the US dollar will do, and the New Zealand dollar is almost an afterthought in this particular point in time.

Watch the Federal Reserve, again.

I hate saying this yet again, but the Federal Reserve will drive this market. It's because they are going to drive the commodity markets that the New Zealand dollar will certainly follow. On top of that, you have to watch whether or not Asian markets are doing well as the economies in that region of the world have slowed down a bit. The New Zealanders supply Asia with a lot of its soft commodities, and as a result they are tied directly to places like China, Indonesia, and the Philippines. With that in mind, it is essentially a play on commodities and Asia, those areas have been going relatively weak lately.

As far as selling is concerned, that is my preferred position. On a break of the hammer from the Tuesday session to the downside, I am more than willing to start selling as the markets look ready to pull back to the 0.77 handle yet again. If we do manage to get above the 0.82 handle on a daily close, I think this market will head towards the 0.85 handle.