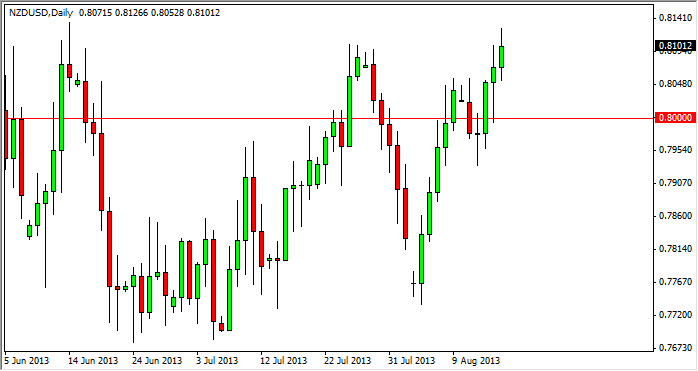

The NZD/USD pair had another positive showing on Friday, breaking above the 0.81 handle money and the day. However, I still see significant resistance all the way up the 0.82, so I'm not overly excited about this move quite yet. Although, I do have to admit that all things being equal this pair does look like it's ready to breakout to the upside.

This of course will be predicated upon whether or not the US dollar loses value, which presently it is. This is because of the Federal Reserve and whether or not they are going to taper off of quantitative easing, and with poor economic numbers coming out United States this week that puts the odds of tapering down quite a bit as the Federal Reserve will continue to try to inflate the economy. This of course drives money into commodities and other "things", to store value. With that being the case, the New Zealand dollar being such a commodity driven currency will of course be attracted to traders, not to mention the fact that there is an interest rate differential between the two that's fairly wide all things considered.

Asia is a factor as well

However, even with all this going on please do not forget the fact that the New Zealanders rely a lot on Asia for their export market. Asian economies are a bit of a mixed bag at the moment, so this is a little bit of a drag on the New Zealand economy. Also, the fact that everything seems to be hinging on whether or not the Federal Reserve will taper off of quantitative easing sets the market up for headline shocks that could throw the currency markets into a fit.

That being the case, you have to be fairly careful, but I believe that the "floor" in this market is at the 0.79 handle at the moment. Below there, things get ugly quick. Between now and then though, I believe that this market will be supportive and we will eventually start breaking out against the Dollar yet again.