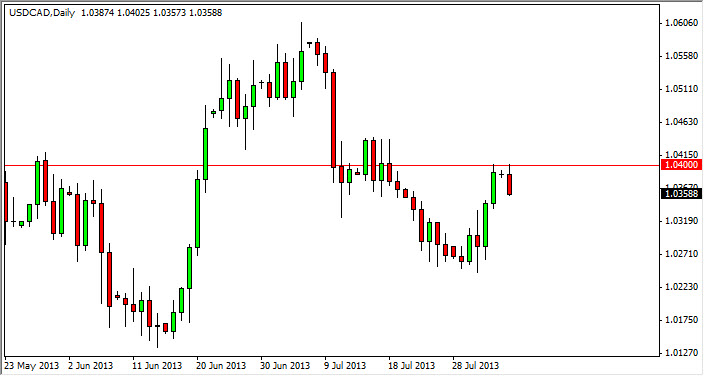

The USD/CAD pair fell during the session on Monday, after attempting to break above the 1.04 handle. With that in mind, it's obvious that this pair has run into significant resistance and it appears that we are in fact going to start falling again. Expect this market to find support down at the 1.0250 level however, and as a result the move down may be somewhat short-lived. On the other hand, if we can get above the 1.0450 level, we would more than likely see this market go much higher.

I have to admit, I do not like this pair at this moment simply because there are too many moving parts. The oil markets are going nuts, and as a result there are some strange influences on this currency pair. If this market falls, we could very well go down to the 1.01 handle, and possibly even lower. However, I don't think any direction is going to be easy for this market as it appears to simply be "stuck."

Federal Reserve

I hate to say this again, but this is coming down to whether or not the Federal Reserve tapers off of quantitative easing in the month of September or October. If they do, expect the US dollar to skyrocket in value and that wouldn't be any different for this pair. In fact, that's the analysis that you can give on almost any currency pair at the moment, simply it comes down to the Fed in what they're doing. Right now, it appears that the Federal Reserve doesn't even know what's going on, so it's no surprise that the market can't get a hand around it either.

I believe that options may be the best way to play this market, simply because of volatility is going to be out of control. That being the case, I am not playing any spot Forex trade in this market right now, and have to admit that my portfolio itself is rather light at this moment. This is probably the most dangerous time of year to trade, so typically be very careful.