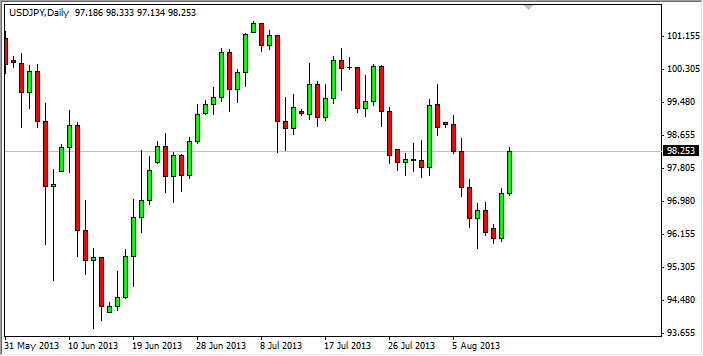

The USD/JPY pair rose during the session on Tuesday, breaking above the 98 handle. The fact that we closed above that level does give me a little bit of hope that we are finally starting to head back north in this pair, and quite frankly that's exactly what I want to see. I didn't get that supportive candle that I was looking for necessarily, but in the bigger scheme of things we should continue much higher. The Bank of Japan will continue to work against the value the Yen, and if the Federal Reserve does actually taper in either September or October, this pair will shoot straight up like a rocket.

There is the possibility that we get a little bit of a pullback in this area, because there is a certain amount of resistance just above. In the end though, I believe that that will simply be another buying opportunity as this pair does continue to go higher over the longer term. I fully expect to see the 110 handle had between now and the end of the year, especially if the Federal Reserve does in fact taper off.

Headlines

Nothing will move this pair like headlines coming out of Washington DC involving the Federal Reserve. If there's even the slightest hint that they may taper in September or October, you can expect this pair to shoot straight up in the air. A lot of speculators out there try to get "in front of the move", and tend to get burned. If they are longer-term traders then it can make sense, but unfortunately a lot of dumb and quick money does this. That's the quickest way to ruin your account, so unless you're willing to hang onto a very volatile situation, you might want to sit out of this market for a few weeks. Personally, I feel that this market will go higher over the long-term, so I'm content simply pyramiding my way up as I build the position larger and larger. Quite frankly, by the time this is all said and done I hope to hold on to this position for about five years.