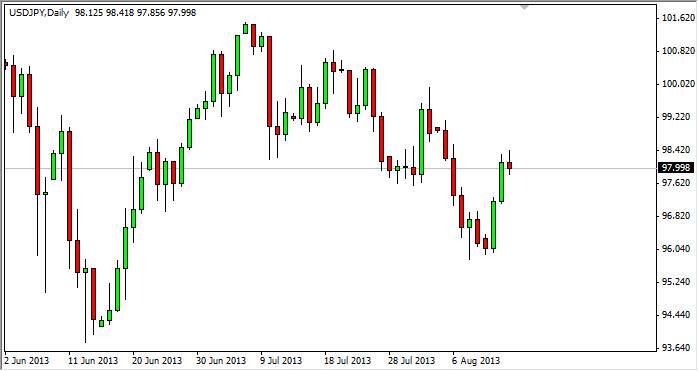

The USD/JPY pair did very little during the session on Wednesday, but it did try to break above the 98 handle and failed. The resulting shooting star of course is a very negative looking candle, and this means that the market could very well pullback from this point in time. That being the case, I think that this market will give buying opportunities below, as I am not a seller of this pair regardless. I am not willing to buy the Yen, especially considering the Bank of Japan will work against the value of the Yen sooner or later. In a sense, this market has a built-in "bid" as traders will buy weakness as it shows.

The last couple of days, I have been suggesting that the 98 handle would be an area of resistance that could cause the pullback that allows traders to reenter the market. I think that's what's going to happen, so I'm going to ignore this sell signal and look at it as a buying opportunity at lower levels.

Federal Reserve

I hate saying this again, but this pair will be greatly affected by what the Federal Reserve does in relation to quantitative easing. If they do in fact taper off during the month of September or October, you can expect the US dollar to skyrocket in value and in this pair especially. Its because the Bank of Japan is going to work against the value of the Japanese yen, so that combination should be a powerful accelerant for the upside momentum.

Regardless, I see no reason to sell this market and every time it falls I simply look at it as being a better value. That value should eventually attract enough traders to start going long again, and that being the case I think that this market will in fact be bid up quite a bit over the course of the next several months. Eventually I think that this market will hit its high as 110 by the end of the year. That will be especially true if the Federal Reserve does in fact taper off.