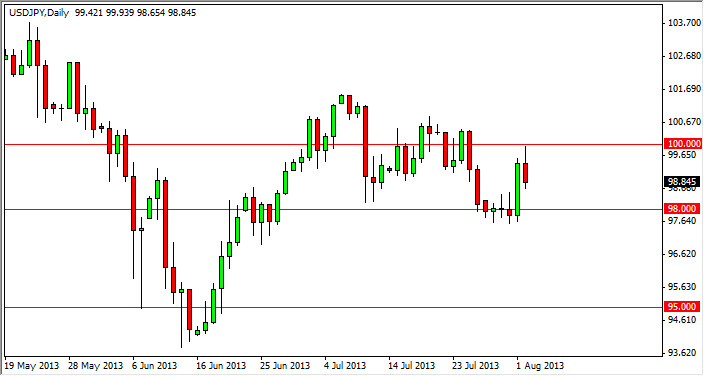

The USD/JPY pair tried to rally during the session on Friday, but as you can see lost ground and fell in order to form a shooting star of sorts. The shooting star of course means a weakness could be coming, but we do not have a market that is one that can be sold at the moment. This is because the Bank of Japan continues to work against the value of the Yen, so as a rule I simply will not short any of the yen related pairs.

However, if we managed to break above the 100 level, I think that would be a very bullish sign and have traders flooding the markets to the upside. In the end though, I do believe that we are going to pull back to the 98 handle, which should be supportive. If we get a supportive candle in that general vicinity, I will not hesitate to start buying again.

Interest rate differentials

A lot of the movement in this market will be based upon the Federal Reserve and whether or not it tapers off the quantitative easing program that has been implemented. If it does, that of course will drive the value the US dollar much higher, especially in this pair considering that the Bank of Japan has just started their quantitative easing efforts. That should send the pair much, much higher, and as a result it would not surprise us to see 110 by the end of year.

I think that a break above the 100 handle shows not only a break above a significant large round number, but the fact that would smash the top of the shooting star would signal that the market is in fact going to the 103 level next. It should be choppy, but quite frankly most Forex pairs are at the moment as this is the dead of holiday season for most larger traders. If we do manage to fall from here, and even if we clear the 98 handle on the downside, I believe that the 95 level will be the "floor" of this market.