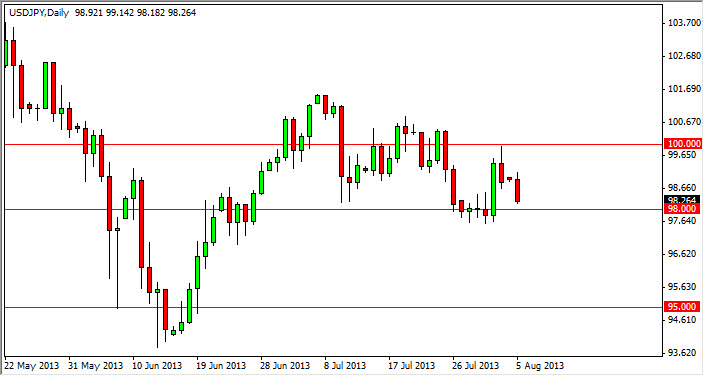

The USD/JPY pair fell during the session on Monday, reaching for the 98 handle. I believe that the 98 handle is going to be supportive, so I do not expect this move to last much longer. Even if we do see this market fall, it's hard to believe that it will get below the 95 level, where significant support should come into play. That being the case, I think that it's only a matter time before I will be buying this market again, and that of course is backed up by the Bank of Japan and its desire to devalue the Yen.

It's only a matter time before I see a supportive candle that I am willing to buy, and I will not sell this market under any circumstances. That being the case, it's essentially a "sit and wait" game at the moment, and I believe that eventually we will get that signal.

Federal Reserve

You also have to watch the Federal Reserve and whether or not they are going to start tapering off of quantitative easing. If they do, that of course will send the value of the US dollar much higher, and this pair won't be any different. On the other hand, if they don't that could throw real wrench in the uptrend of this pair, although it does have the Bank of Japan pushing in the other direction.

I believe that eventually this market will go to the 102 level, and then possibly 103 and 105. I still believe the 110 is possible by the end of the year, but it does need the Federal Reserve to start tapering off. If they don't, expect much more of a fight to the upside, even though the uptrend should reassert itself once the larger traders come back into play late September. Certainly, you can short from time to time, but quite frankly that's a very risky game to play in a market that is so headline driven. Going forward, I'm not even going to pay attention to any sell signals, it's just safer that way.