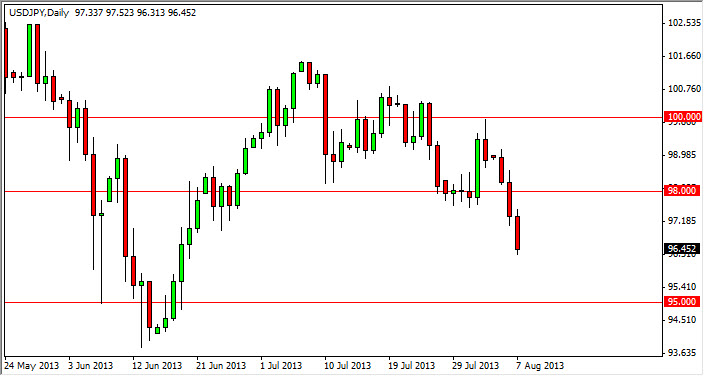

The USD/JPY pair fell hard during the session on Wednesday, as the back and forth nonsense involving The Federal Reserve continues. Looking at this chart, I can make a serious argument for a move down to 95, but quite frankly shorting this pair is tantamount to financial suicide as words coming out of the Bank of Japan could change things in a heartbeat.

Going forward, I fully expect to see support underneath this area and I do think that the 95 level is the "floor" in this market as the Bank of Japan will certainly get involved underneath there. The tapering or not of quantitative easing in the month of September and October of course is the biggest question in the markets right now, and this is the pair that will show the reaction most drastically.

Watch the bond markets

The bond markets will drive what this currency pair does. The US 10 year note and the Japanese 10 year note difference typically drives the direction of this pair. The Bank of Japan is currently buying up 10 year notes in Japan hand over fist, and as a result I think that this pair will continue to rise over longer-term time frames.

However, I do not see a supportive candle in order to start buying at this moment time, so it's very difficult to place a trade. I think it's simply a matter of waiting for the market to come back to you, and then buying. That being the case going forward, I think that this market will eventually hit the 100 level again, the 103 level, and the 105 level. Whether or not we can get above 105 will probably come down to the Federal Reserve, but if they do taper I see no reason why won't hit the 110 level before the year is over.

As far as shorting is concerned I have aptly no scenario in which I would like to do so, so having said that I think that we will more than likely see a little bit of meandering lower, before seeing a pop higher.