The USD/JPY pair has been an interesting market to watch, simply because there are so many moving pieces at one point in time. After all, on one side of the Pacific Ocean you have the Bank of Japan working against the value of the Yen overall, by mainly purchasing bonds and making verbal threats in the currency markets. On the other side of the Pacific, you have the United States which appears to be ready to start thinking about cutting back on quantitative easing. Because of this, we could see a nice move in this pair that continues over the long-term, possibly for years.

However, the idea of tapering off of quantitative easing in the month of September isn't necessarily a slam-dunk at this point. After all, there have been conflicting reports about what various board members on the Federal Reserve want to do. Nonetheless, the most recent minutes to come out of the central bank suggested that more and more people are coming to the side of Ben Bernanke, it seems to be ready to back off of quantitative easing fairly soon. If that's the case, this pair should go straight up as you have one central bank working against its own currency, while another one is at the very least slowing down its self-destructive actions.

Expect a lot of noise until the middle of September.

Quite frankly, this pair is going to be very difficult to trade for the next couple of weeks. However, if the central banks do what traders are expecting them to do, this pair should continue to rise over the long-term and might be a nice long-term trade for investors as well as speculators.

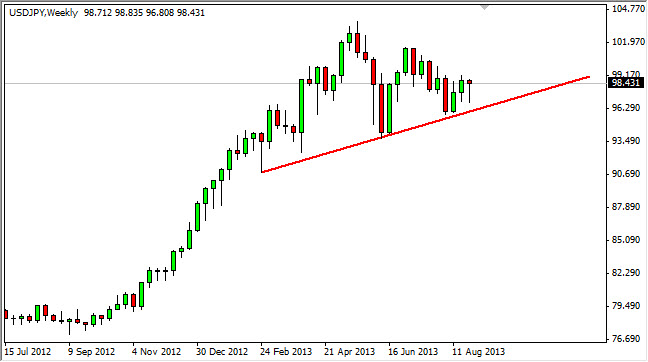

As you can see on the chart, I have drawn an uptrend line that the market has been falling since the beginning of 2013, and at this point in time it appears that the market will continue to go higher case upon that dynamic support. Because of this, I would have to trade on the side of caution, and assume this pair is going to go higher. However, if the Federal Reserve does not taper off of quantitative easing, you can expect a massive and sharp move lower.