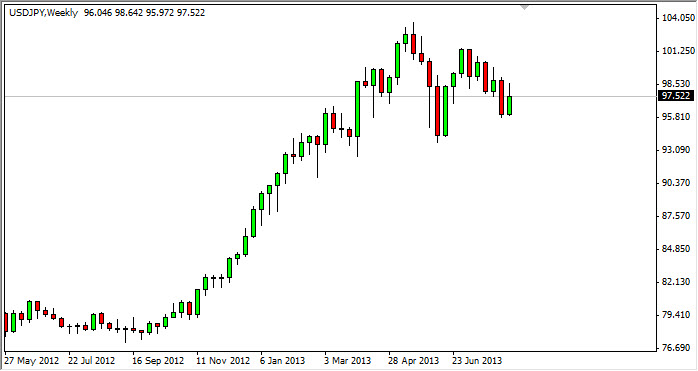

EUR/USD

The Euro initially fell during the previous week, but as you can see we have bounced in order to form a hammer. I believe that the hammer signifies that we could very well break above the 1.34 level, an area that I think is vital for continued bullishness. Because of this, I expect this pair to breakout in the near-term, but the real question will be whether or not the Federal Reserve will taper off of quantitative easing or not. If they do not, expect this pair to continue to go higher. If they do, there will be a massive reversal. Also, keep an eye on the bottom of the hammer from this week. If we break down below that, this pair could get ugly fast.

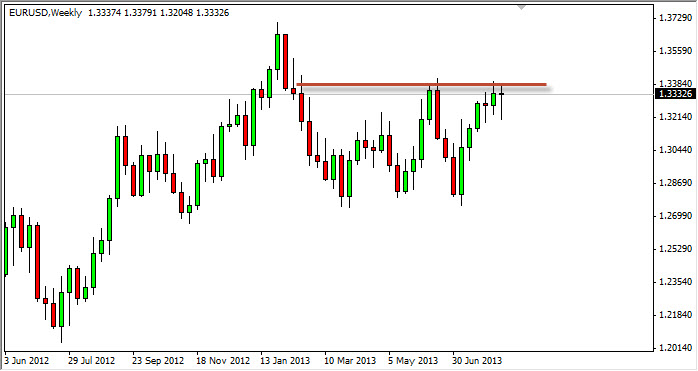

AUD/USD

The Australian dollar initially fell during the week, but as you can see bounced just like the Euro did. Essentially we have the same set up, but instead of trying to get above the 1.34 level like we are in the Euro, I believe that a breakout occurs at the 0.9350 handle. Because of this, we aren't quite close enough to that area for me to get too excited, and I do recognize that there is the possibility that this is a little bit of a fake out. Nonetheless, above that area I am a buyer.

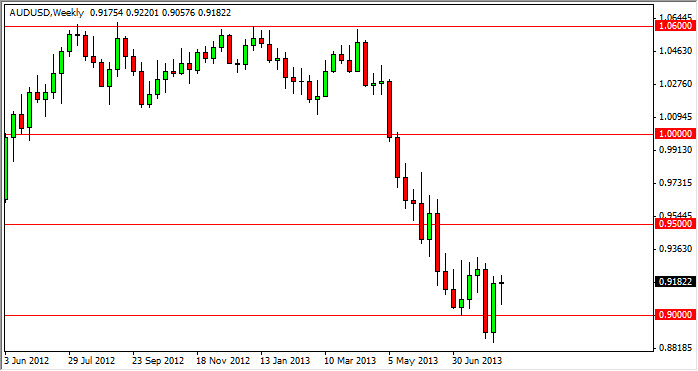

GBP/USD

The British pound had a fairly decent week as well, but initially dipped below the 1.55 support level. However, by the end of the Friday session we saw this market go much higher. At this moment in time, I believe that we are heading to 1.5750 first, and then the real fun begins. If we can get above that level, I see no reason why we will go to at least 1.60, and probably higher. However, if there's ever a spot on this chart that is going offer enough resistance to reverse everything, the 1.5750 level is definitely it.

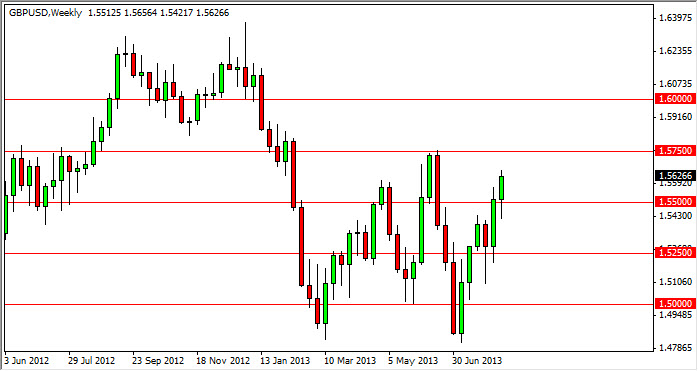

USD/JPY

The USD/JPY pair had a positive showing this week, but as you can see struggled above the 97.5 level. That being the case, it looks like we're going to consolidate even further and it makes complete sense if you think about it - the Federal Reserve and its quantitative easing program are the focus of the marketplace, and as a result a lot of uncertainty still fills the air. With that being the case, I believe this will be the pair to be associated with after that announcement is made. The question is which direction does the Dollar go? If the dollar strengthens due to tapering off of quantitative easing, this pair will absolutely skyrocket.