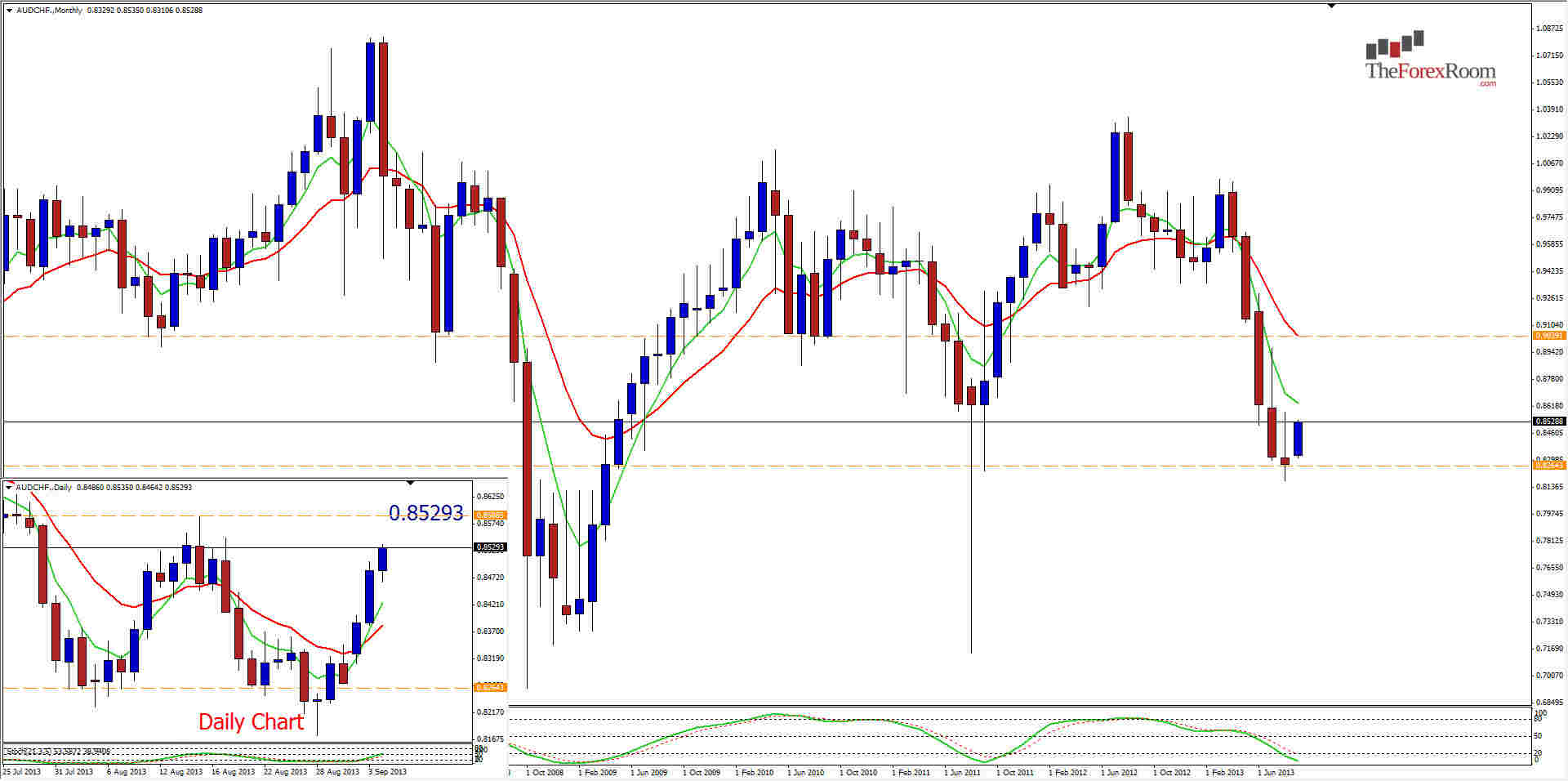

The AUD/CHF may have found a floor at last week’s low of 0.8175. The pair printed an Inverted Hammer on the monthly chart on the support zone at 0.8260 and has since spent 3 of the last 4 days climbing.

In order for the Monthly candle to confirm that it is indeed a bullish signal, typically we need to see price break last months high of 0.8587 which is coincidentally the next resistance level, and a relatively strong one at that. If price does in fact clear this zone, we can expect further resistance at the 0.8750 after clearing the Daily 62EMA at 0.8600.

Looking farther out, this pair has been falling a long time, and even a 38.2% retracement would land the pair at or around 0.8860 with a 50% retracement sitting at the same spot as the Daily 200EMA of 0.9075.

Falling lower however would put the pair possibly back into a consolidation area and see the same support levels that are now propping it up come back into play, such as 0.8450 and 0.8360.