By: DailyForex.com

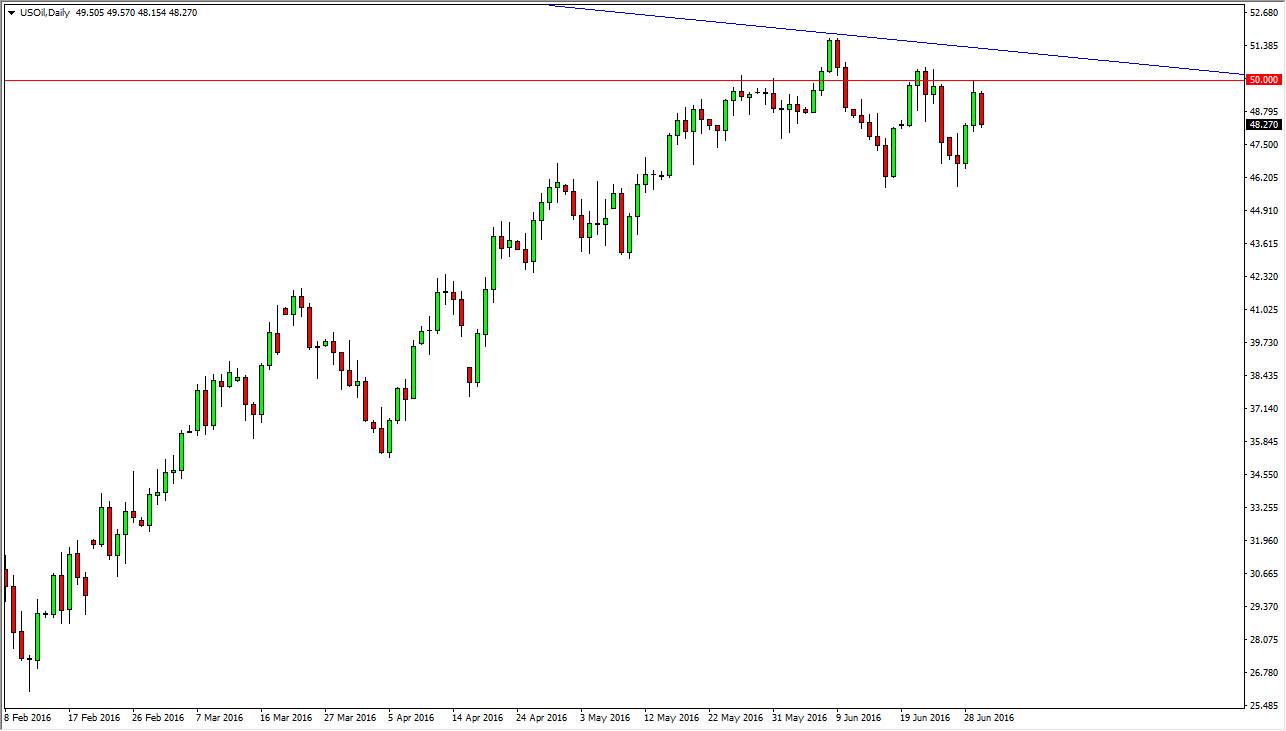

The WTI Crude Oil markets fell during the session on Wednesday, but as you can see found support at roughly the same area the markets pushed the price back up to at the end of the session on Tuesday. With that being the case, it appears that this market of course does have support, and as a result I feel that buying on a break of the highest from the hammer that had printed on Tuesday will be the proper course of action to take.

However, I also would not hesitate to point out the fact that the shooting star from last week still hasn't been violated to the upside, and it appears that the $107 level will continue to be resistive. That being said, I feel that the market could go back and forth in a relatively tight area in the near-term, and because of that the markets will more than likely be of the short-term variety at best.

Watch the headlines

Headlines will certainly cause a lot of drama in this market going forward, but having said that it still looks like this market is overall going to be relatively strong. I understand that a lot of noise coming out of Egypt and Syria will more than likely push the markets around, but you have to keep in mind that this grade of oil doesn't come out of that region, so sooner or later sanity will come back into the marketplace.

On top of that, nobody is closing the Suez Canal, and the Egyptians aren't exactly an oil-producing powerhouse. However, it doesn't really matter as the markets are being pushed around by larger traders taking advantage of a lot of the drama. In fact, by the time the general public tends to get into the game of pushing the markets up, the big money has already withdrawn from the market and collected profits. Going forward, I believe that this market will ultimately try it the $110 level, but expect a very bumpy ride and we are waiting to find out what happens with the Federal Reserve and its quantitative easing program.