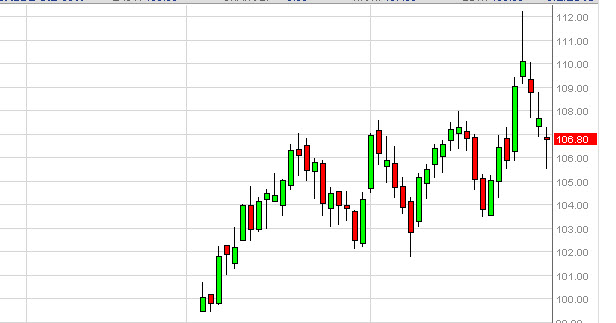

The WTI Crude Oil markets did very little during the session on Monday as Americans and Canadians celebrated Labor Day. However, there was limited electronic trading during the session, which of course produced a significant hammer. As far as I can tell, this only reinforces the idea of there being a lot of support down in the previous consolidation zone, and as a result I think that we are now starting to see another buying opportunity.

After all, it now appears that somebody is going to bomb Syria after all. The United States is sending warships to the region, and NATO now suggests that it has "concrete evidence" that the Syrians have in fact used chemical weapons on their own people. With that being the case, oil markets of course got jittery as a strike it seems almost inevitable. However, you have to keep in mind that quite often when these military actions start, oil markets will completely freak out and then settled back down as soon as the actual shots are fired. I believe this may happen again.

Short-term buying opportunity

I believe that for the next several sessions this market should continue to go higher. However, you should keep in mind that WTI stands for West Texas Intermediate. In other words, it's not found in the Middle East. Nonetheless, it has a knock on effect when the possible buying of WTI as a replacement for Brent crude comes into play.

In fact, if you have the ability to play the Brent crude contract, that's probably where the real money is going to be made. However, a quick move back to the $110 level seems reasonable for this market, but I would expect a bit of choppiness as this is basically fear driven, something that tends to be very fickle. As far as selling is concerned, I see way too much in the way of support below in order to consider it, and as a result have absolutely no thoughts in that direction. Another possible driver of oil prices going forward will be the Federal Reserve and whether or not they taper off of quantitative easing. In other words, it's time to buckle your seatbelts because this is going to be a bumpy ride.