The EUR/JPY pair is one of my favorite pairs to trade, simply because it is such a cure play on alpha. What I mean by this is that if general market attitude is good, this pair typically rises as time goes on. After all, the Japanese yen is considered a safety currency, while the Euro is a limit more of a risk assets. Having said that, you have to keep in mind that the Euro is in that "risky", but it certainly is more so than the currency we see coming out of Japan.

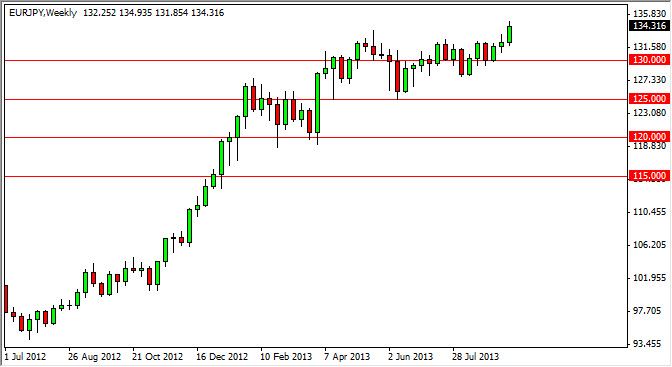

Looking at this chart, you can see that we have broken out above the 134 handle, an area that was significant resistance. Because of this, I think that it has been written on the wall so to speak that this market will continue higher. In fact, I would fully expect to see the 140 handle it sometime in the relatively near term. I do not know that it will happen in October, but we are certainly heading in that direction.

135

The real key to this is going to be breaking through the 135 level. Although I do believe it will happen, you could see a bit of noise there as the large round psychological number offers resistance. That being the case, you should only be holding onto this trade if you have the wherewithal to do so. Otherwise, you may have to wait until we close above 135 on a daily candle in order to feel comfortable going long.

As you can see on this chart, it has been very symmetrical on the way up. Every 500 pips or so we get a reaction, and that is what I'm basing the next target on. I know it seems rather simplistic, but sometimes these markets truly do move in specific patterns like this. This is one of those markets did well known for doing that type of action, and as a result I feel fairly confident in the bullishness ahead. As far as selling is concerned, I think every time this market pulls back, it's a buying opportunity.