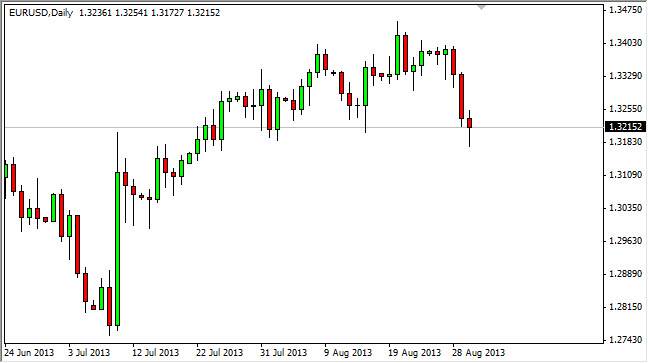

The EUR/USD pair fell during the session on Friday, but as you can see the 1.32 level did in fact offer enough support to form a hammer. This hammer of course signifies that support has come back into the marketplace and what I find truly interesting is that the 1.32 level is the bottom of the recent consolidation. In other words - if there was a place you wanted to see this hammer appear, this is it.

That being said, I think that the market is simply stating that it's not ready to make a larger term move before the Federal Reserve speaks about quantitative easing and whether or not it's going to taper. So in that aspect I think that we are setting up for a short-term bounce, but I think the 1.34 level on the top of the consolidation area should keep buyers away.

Continuation of the consolidation

I quite frankly feel that this pair is going to keep on bouncing between 1.32 and the 1.34 handles. With that being said, this is a good short-term trader’s kind of market as we have clearly defined areas. Because of this, I will be buying this pair on a break of the highs from the Friday candle and aiming for roughly 1.3390 in order to take advantage of what is a clearly defined area. That being the case, I suspect that a lot of other traders out there are seeing the same thing, so this is a real chance of becoming a bit of a "self-fulfilling prophecy."

On the other hand though, there is the possibility that we break down below the lows from the Friday session. If we do that, I think that would become a very negative sign and we could very easily find ourselves trying to reach the 1.28 handle over the course of the next several weeks. However, I believe that is going to take the Federal Reserve announcing that they are tapering to attempt at that, so I suspect that move wouldn't come for a while as we await the announcement.