Now that we finally have some clarity as to what the Federal Reserve might be doing involving quantitative easing, it now appears that the US dollar will continue to be on the back foot. With that being the case though, we have to wonder what the markets will interpret the lack of tapering to mean in the end.

Because although it is dollar negative, it does also suggest that perhaps the economy isn't moving quite as strong as originally expected. If that's the case, a roundabout way the US dollar typically does fairly well as a safe haven bid. With that being the case, this pair almost exclusively will rely on news out of the European Union.

The European Union recently exited a recession, and that of course is going to be good for the Euro. This is especially true if the Federal Reserve now looks like it's ready to extend quantitative easing into the early part of the next year, which of course gives us plenty of time to see dollar weakness. If the European economic numbers are good, I don't see any chance of this pair falling for any significant amount of time.

1.40

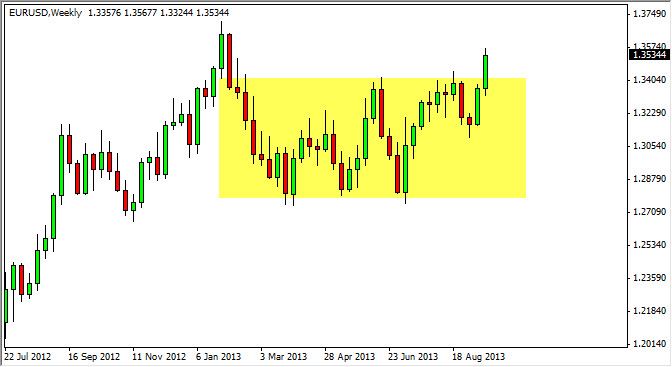

I believe that this market will eventually try to find the 1.40 level, although it might be a bit choppy on the way out there. As I write this, it is 20 September, and we are currently trading right around the 1.35 handle. We have broken through the bid, so the next natural place to find significant resistance will be at the 1.40 level. That being the case, I think that's where were heading to, but we need good economic numbers out of Europe.

The other thing to pay attention to is the US jobs report. Quite frankly, if that starts to pick up positive motion, we could see this market turned back around and start falling. However, at this point in time I really doubt that's the case in most market participants will look at any pullback as a potential buying opportunity in this very strong market.