Last Wednesday's analysis ended like this:

Worthwhile recommendations are:

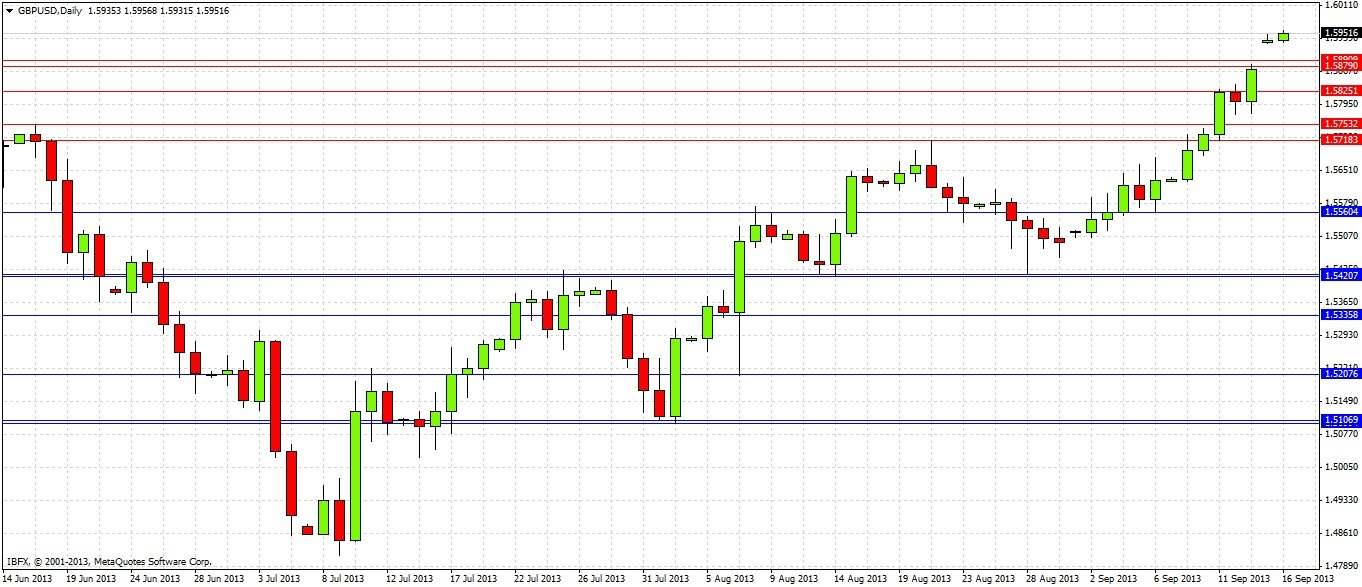

1. Maintain a bullish bias unless 1.5718 is decisively broken to the down side, or until there is a reversal off 1.5825, or until 1.5875.

2. Look for longs at a bullish reversal off 1.5560.

3. Look for longs at 1.5425.

4. Look for shorts off bearish reversals from 1.5750, 1.5825 or at 5875.

This forecast was perfectly accurate. The level of 1.5718 was never broken and maintaining a bullish bias was correct as price rose to 1.5875 by Friday's close.

The price hit 1.5825 on Wednesday and reversed off that level twice on Thursday, providing short-term counter-trend winning short trades of 20-30 pips. The price then rose to 1.5875 on Friday, providing a profit target for the bullish bias that was reached in time to close out trades by the weekend.

The price opened last night with a sharp gap up over the resistance at 1.5875, and at the time of writing the gap has not been filled, in fact the pair has not traded lower than 1.5929, and a high of 1.5957 has already been made.

Turning to the future, let's begin by taking a look at the daily chart

The action has been very bullish this week, following last week's bullish reversal candle. This week closed right next to its high. Things look very bullish. However, we have reached beyond a zone at 1.5890 to 1.5875 that has acted as both support (see 1) and resistance (see 2) the last time it was reached, so it is questionable whether the price is going to be able to move higher now without a pull back or some kind of struggle. A weekend gap this large (almost 50 pips) usually gets filled quite quickly.

Let's take a closer look at recent action:

The daily action was bullish every day last week, with daily closes close by each daily high, with the exception of Thursday's pull back. Thursday's pull back was engulfed by a bullish reversal Friday.

The momentum is very bullish, but as mentioned previously, we have passed a zone that was likely to provide resistance, between 1.5890 and 1.5875. There is no reason why the price cannot get to 1.6000 and possibly even some way beyond that fairly soon. The 1.6000 level should be key psychologically after the fairly fast upwards move we have had over recent weeks, although the strong resistance levels are likely to appear above that, at areas such as 1.6250 to 1.6300 where we have long-term swing highs that have held for 2 years.

However, if the gap fills quickly before we reach 1.6000, we are very likely to see a fall to levels such as 1.5825, 1.5750, and 1.5718. A key question is which of these levels will hold. If 1.5825 breaks easily, a short trade down to 1.5750 and possibly 1.5718 becomes practical.

Due to the large gap, it is a good time to be careful, and take long profits. A bearish reversal at 1.6000 could be a good short trade, at least down to the level of the gap. Otherwise it will probably be best to wait and see what happens around the lower levels previously mentioned before making any long or short trades.