Last Wednesday's analysis ended with the following predictions:

1. The price is likely to reach 1.6000 and beyond soon.

2. The 1.6000 level is likely to act as a key psychological level.

3. There will probably be strong resistance at 1.6250 to 1.6300, a long-term swing high zone.

4. If support at 1.5879 does not hold, we are likely to see further moves down to the levels of 1.5825, 1.5750, and 1.5718.

5. It should be profitable to trade short on a decisive break down of the 1.5825 level, using 1.5750 and 1.5718 as target.

What has actually happened over the week that has passed since then, is that the price moved sharply up to a high of 1.6162 that same night, and has been falling fairly steadily ever since. The technical significance of 1.6000 was forgotten in the surprising announcement by the Fed about continuing without tapering, which had the immediate effect of weakening the USD temporarily.

The forecast failed to identify the supply that stopped the move up at 1.6162, well before the 1.6250 – 1.6300 zone that was identified.

In other respects, the remaining elements of the forecast have not been tested yet, as the price has not fallen further than yesterday's low of 1.5954.

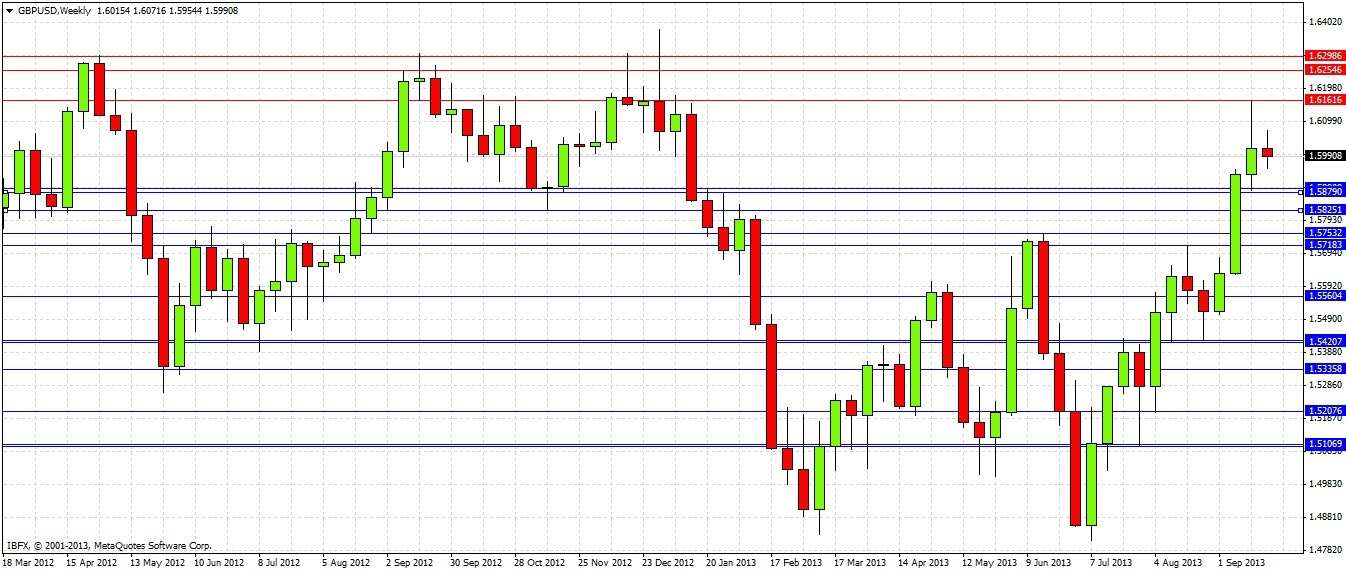

Turning to the future, let's start by taking a look at the weekly chart

The chart shows that last week closed up, following on from the bullish move of recent weeks, but with a large upper candle. This indicates that we hit some resistance and that things are quite likely to have entered a bearish phase. If you look to the left from the high of last week, you can see that the high of 1.6162 did more or less coincide with a couple of consecutive weekly highs when the price was last at this level. The action so far this week has also been somewhat bearish.

Let's drill down for some more detail by taking a look at the daily chart

The chart shows that the daily action has been quiet since last Thursday, with the price moving through only small daily ranges, none of which have exceeded 85 pips. Price began the falling-off with a bearish inside bar on Thursday which is acting as supply, and the predominant moves have been bearish. There is a mini-gap and support below at 1.5879 which the price has not yet reached.

Predictions for the coming week are as follows:

1. It seems that we have begun a down trend. This will become more obvious when the price breaks down through 1.5879 which until then should act as short-term support.

2. A pull-back to the area above 1.6025 should be a good place to enter a short trade.

3. The support levels at 1.5879, 1.5825, 1.5750, and 1.5718 are still intact and should be used as profit targets or for conservative longs.

4. If we get a daily close above 1.6075, the down trend will have ended.