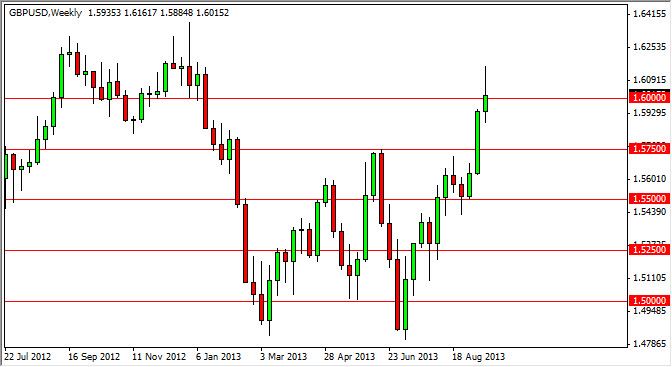

The GBP/USD pair has had a nice run over the last several weeks, but as you can see the 1.60 level has in fact offered enough resistance in order to form a weekly shooting star. That being the case, I believe that we are starting to run into fairly significant resistance, and as a result of pullback over the next several weeks, and going into the month of October is more than likely at this point.

What I find interesting is that the Federal Reserve did in fact decide to hold off on tapering, and that being the case the US dollar should have been absolutely pummeled. However, the markets have started ask whether or not there's going to be any economic growth globally. If that's the case, the US dollar wins by default. I think this is what we are starting to see in this pair, and now it looks to me like the area between 1.60 and 1.63 is going to be massively resistant, and very unlikely to give way to the buyers.

Trouble ahead

Looking at this market, I think that the pullback will probably head towards the 1.55 level, and then just bounce around between there and 1.60 in the course of the month. However, if we do manage to clear the 1.64 level that will certainly be very negative for the dollar, and the British pound will have taken off at that point. Quite frankly, this market is acting like a lot of the other Forex markets right now, and showing that there is still a lot of confusion.

You have no idea how aggravating this is for an analyst, simply because it appeared that we were going to be focused on the Federal Reserve more than anything else. Now that we've had the announcement, it appears in a lot of ways, things simply have not changed. Expect a lot of jagged and choppy action over the next several weeks, and I do not believe that October is going to be any different than we've seen over the last couple of months.