Last Monday's analysis ended like this:

"The low of the original bearish reversal candle at 1.5614 is a key level however, this should act as resistance and it is very close to the key weekly level of 1.5611 that was already mentioned. These levels should act as overhead resistance.

The key levels to watch out for are 1.5422 below and 1.5614 above. A reversal off whichever of these levels is reached first could be a good trade. As there is no strong trend, just trading the levels could work well.

If 1.5421 breaks soon and decisively with a daily close below that level, we will probably fall to 1.5350, which should act as strong support."

The resistance levels of 1.5611/14 were רreached first, they were tested last Wednesday but barely held for a few hours, so a touch trade from these levels could only have made a few pips, depending upon the stop loss. If you had waited for a reversal, you would not have got into any trade.

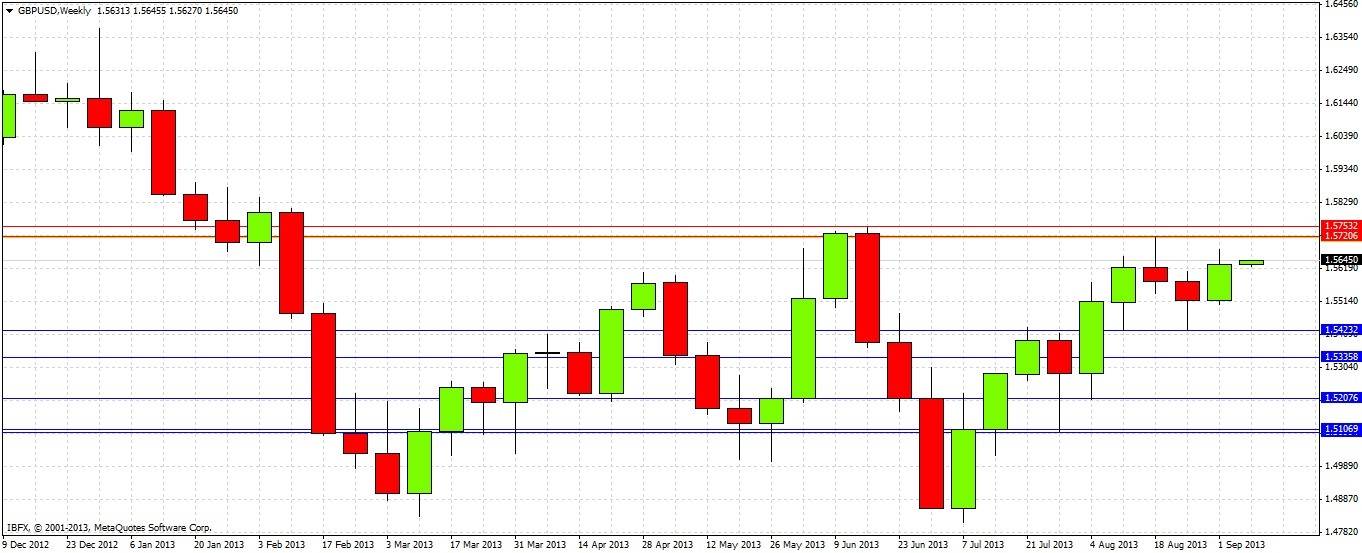

Let's take a look at the weekly chart:

Last week was a bullish reversal candle, it also closed above the previous week's high, and the open of the week before that. This indicates bullishness, showing that we can expect 1.5680 before we reach 1.5504, in fact getting back up to the resistance zone between 1.5730/50 first is likely.

Let's drill down to the daily chart to take a closer look:

We can see that the daily action last week was bullish with the exception of one day, and that both Friday (1) and Monday (2) were bullish reversals, however both closed a long way off their highs, which is a sign of weak bullishness. Friday was caused by the NFP news spike Friday so the close is more significant than the high. So the daily chart is also indicating bullishness, but weakly so. We are approaching a zone of resistance which was formed by the last strong reversal candle, which was also an outside candle (3).

From the messages that the charts are giving us, it makes sense to open this week with only a weak long bias. The worrying thing is that the action in this pair has become quite thin, the moves are not strong and seem to lack real conviction. That can change quickly, but as things stand it is hard to feel the kind of momentum necessary to break through the key psychological/resistance level at 1.5750. Until 1.5730 is reached, barring any strong bearishness, it will be best to maintain a bullish bias and look for longs.

As direction is not very strong, it would be advisable to look for short opportunities from 1.5730 to 1.5750, and long opportunities at 1.5423.