Gold prices (XAU/USD) settled lower yesterday on easing Syrian tensions and speculations the Federal Reserve will adjust the pace of monthly asset purchases based on improvement in the economic outlook (currently the Fed purchases longer-term treasury securities at a pace of $45 billion per month and mortgage-backed securities at a pace of $40 billion per month).

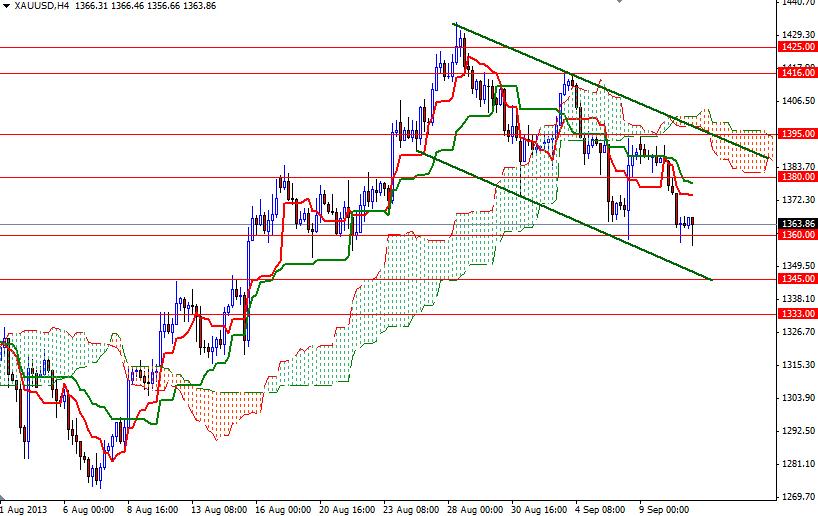

After breaking below the 1380 support level, the XAU/USD pair hit the lowest level since August 22. The pair is currently trading at 1363.86 and it seems that the bears are getting ready to tackle 1353 and 1345 support levels. However, looking at the daily chart from a purely technical point of view, the odds favor a bit of a bounce at this point because the bottom line of the ascending channel which the pair has been following for almost 12 weeks sits here.

If the bulls successfully hold the pair inside the ascending channel and prices reverse, expect to see resistance at the 1380 and 1395 levels which defines the borders of the Ichimoku cloud on the 4-hour time frame. I think that climbing above the 1400 level would lure some investors back to the market and increase the possibility of a bullish attempt to revisit the 1416 – 1425 resistance area. If the bears want to dominate the market, they will have to pull prices below the 1345 level on a daily basis. In that case, I would be looking for 1333 and 1324 which happens to be the Fibonacci 23.6 retracement based on the bearish run from 1795.75 to 1180.21.