After three consecutive days of losses, the XAU/USD pair closed higher than opening on renewed Syria worries and strikes at South African gold mines. It appears that gold investors are paying less attention to impressive string of data out of the U.S. since the fear factor came back into the market. The Institute for Supply Management’s manufacturing PMI came in stronger than expected with a print of 55.7 and construction spending rose 0.6%.

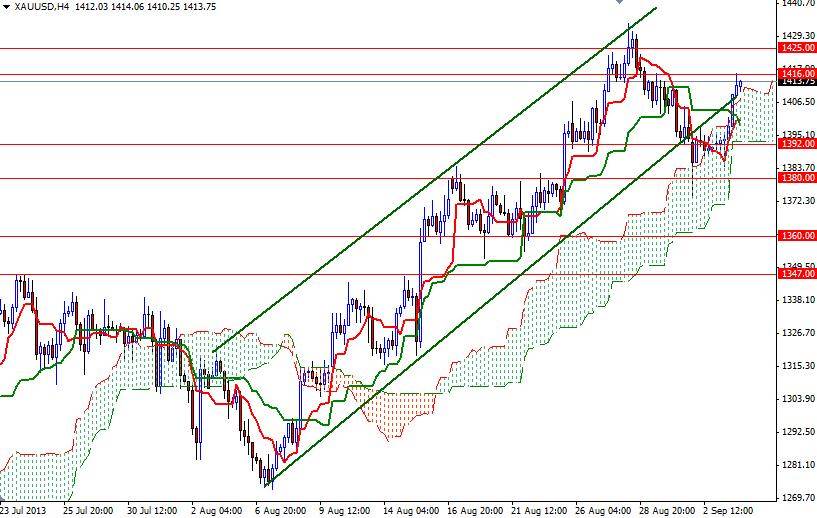

The XAU/USD pair managed to break above the 1408 resistance level which I pointed out yesterday and traded as high as 1416.29 after President Obama won support from leaders in the U.S. Congress for a military action against Syria. Speaker of the House of Representatives John Boehner said “The use of these weapons has to be responded to, and only the U.S. has the capability. I’m going to support the president’s call for action and I believe my colleagues should support this call for action”. Since we climbed above the Ichimoku cloud and the daily chart and broke above the 1347 level, the gold market has been looking for reasons to go higher. Because of that I think the bulls will be taking advantage of this situation and try to break through 1416 - 1425 zone.

A daily close above the 1425 level would indicate that there is a possibility of prices heading lower towards the top of the ascending channel which currently sits at 1448. However, gold's gains might be limited as investors expect that the U.S. Federal Reserve will begin to scale back its bond purchases at its September 17-18 meeting. If the bears regain control and prices start to fall, there will be support at 1400 and 1392. Breaking below the 1392 level -which happens to be the bottom of the cloud on the 4-hour chart- would make me think that the bulls are running out steam. If that is the case, 1380 and 1360 will be the next possible targets.