The XAU/USD pair (Gold vs. the American Dollar) continued to sink yesterday and touched the lowest since August 9 during today's Asian session. The recent price action indicates that gold market participants are in a cautious mode ahead of the Federal Open Market Committee announcement and Fed Chairman Bernanke's press conference.

Since the minutes from the latest meeting had showed that the Federal Reserve is much closer to reducing the pace of its purchases to maintain appropriate policy accommodation, the outcome of this meeting will be critical. Although the economic recovery is somewhat weaker than the Fed's forecasts, the labor market is in a better shape than it was at the time of the quantitative easing launch. Of course, there is still a possibility that Fed policy makers would surprise the markets.

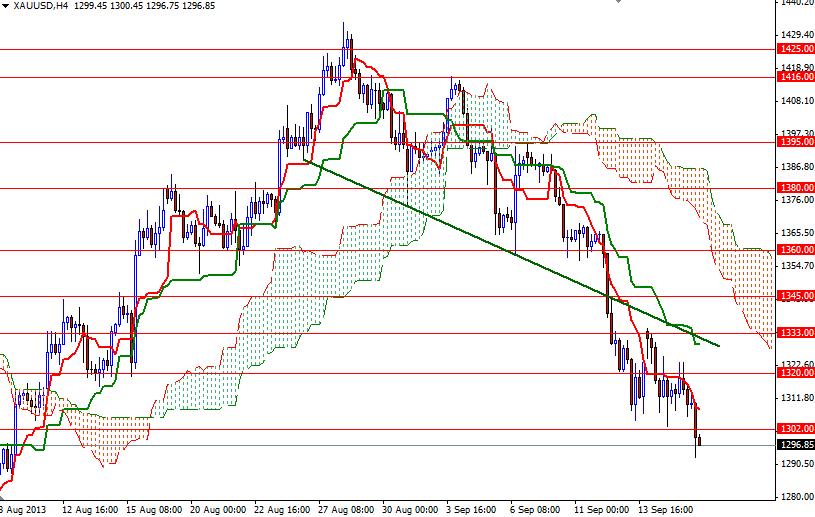

Technically speaking, trading below the Ichimoku cloud on the 4-hour time frame is negative for gold prices and I have no intention of buying gold until we close above the clouds and the Tenkan-sen (nine-period moving average, red line) crosses over the Kijun-sen line (twenty six-day moving average, green line).

The daily chart also gives a warning signal as we are about to test the 1291 support level. If we close below this level, the daily chart will turn bearish as well and the XAU/USD pair might accelerate its decline. If that is the case, the next support levels to pay attention will be 1283.70, 1275 and 1269. However, if the bulls manage to defend 1291 and prices turn north, expect to see resistance in the 1302 and 1323 zone.

In order to ease selling pressure, the bulls will have to capture the first strategic fort at 1333. Beyond this level, there will be resistance at 1345 and 1353. Only a close above 1353 could give the bulls the extra strength they need to reach the 1380 level.