The XAU/USD pair continued to retreat on Friday as strength in the American dollar and weakening demand helped sellers to dodge the bulls' attacks. As a result, the pair printed a shooting star on the weekly chart.

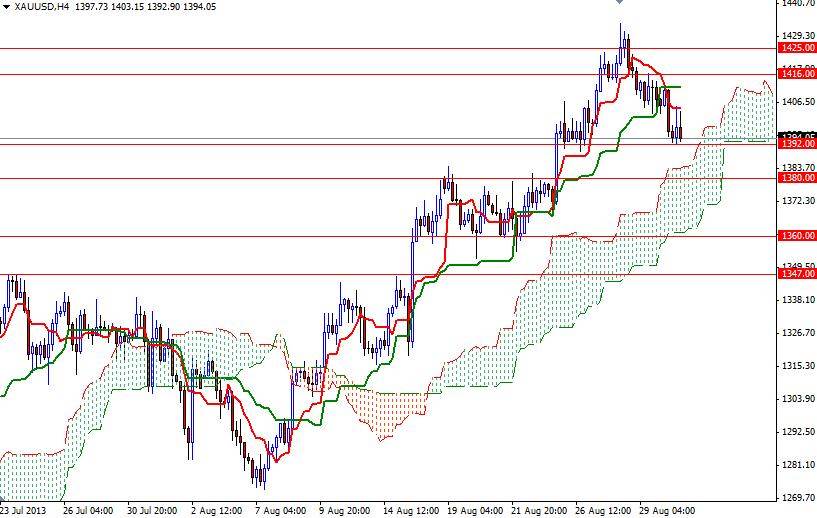

Gold prices tried to break above the 1416 - 1425 zone where the Fibonacci 38.2 retracement level (based on the bearish run from 1795.75 to 1180.21) sits but failed eventually. However, this was not a big surprise. In my precious analysis I had reminded that this zone might offer strong resistance as we witnessed back in May-June. This long wick on the upside, combined with the location of this candlestick, indicates that the XAU/USD pair found heavy resistance and higher prices are rejected by investors at the moment.

According to data from the U.S. Mint, sales of gold coins dropped to 11500 ounces in August from 50500 ounces a month earlier. On the other hand, the latest report from the Commodity Futures Trading Commission (CFTC) showed that speculative investors increased their net-long position in gold to 78289 contracts, from 60396 a week earlier.

Although the U.S. debt ceiling worries have returned to the surface and concerns over possible U.S. military action against Syria put the precious metal back in the spotlights, the possibility of a reduction in Fed's quantitative easing program might trigger some more profit taking. Friday's data from the world's biggest economy were mixed. University of Michigan consumer sentiment index and Chicago purchasing managers' index data were not so impressive but were more or less in line with market expectations.

A heavy slate of key economic indicators will be released this week, including ADP non-farm employment change, ISM manufacturing and services PMIs, but of course the highlight of the week will come on Friday when the Labor Department releases its employment report for August. In the short term, I think the key levels to watch will be 1392 and 1408. If the bulls can push the pair above the 1408 level, we might see another bullish attempt to break through (1416) 1425. Only a close above this level could make me think that the bulls are strong enough to tackle 1455. If prices fall below 1392 and continue to head south, expect to see support at 1380 and 1360.