The XAU/USD pair tried to rally on expectations the Federal Reserve will not begin to wind down its $85 billion a month in asset purchases before the end of 2013 but contradicting messages from policy makers left investors completely confused.

On Friday, gold prices fell sharply and gave back almost all of the gains made in the previous sessions after Federal Reserve Bank of St. Louis President James Bullard put tapering back on the table. He said “This was a close decision here in September, so it’s possible you could get some data that change the complexion of the outlook and could make the committee be comfortable with a small taper in October”. Consequently, the precious metal lost ground against the American dollar last week. It appears that Fed's decision was not enough for the bulls to overtake the bears.

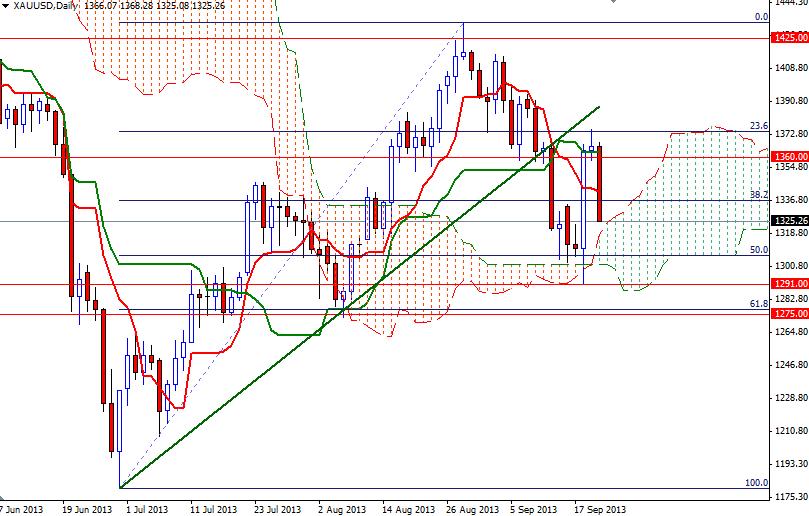

Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold (for the third consecutive week) to 58796 contracts, from 68724 a week earlier. For 3 weeks in a row, gold prices (weekly bars) printed lower highs and lower lows. In addition, the pair failed to break through the 1380 resistance level and closed below the Ichimoku cloud on the 4-hour chart.

Technical outlook suggests that the bulls have been losing strength since that the pair hit 1433.70 4 weeks ago. However, it might be too early to tell that the correction is over because the XAU/USD pair is still trading above the Ichimoku cloud on the daily time frame.

Based on the charts, I think the weekly range will be between 1291 and 1360. The bulls will need to push the pair above the 1337 in order to test the next barriers which happen to be at 1345 and 1360. Penetrating this resistance level might give the bulls extra power they need to tackle a critical resistance at 1380. To the downside, I expect to see some support at 1320 and 1305/2. If this floor is breached, I think the 1291 will be tested. Closing below the 1291/75 support area would put the broader downtrend in focus.