The XAU/USD pair initially fell during yesterday’s session but bounced enough to form a hammer-like candle just above the 1305 support level. After breaking below the 1318 support level, gold prices hit the lowest level in 4 days.

However, disappointing U.S. consumer confidence data and a report from Moody's Investors Service helped gold prices to climb above this level. According to data from the Conference Board, consumer confidence index declined to 79.7 from a revised 81.8 in August. Moody's said “We expect the US will both avoid a shutdown and increase the debt limit; failure at either would have negative economic consequences.

A failure to raise the federal debt limit, however, would have greater adverse financial market and economic consequences because market participants would perceive an increased probability of sovereign default”. I think some investors' desire for safe haven diversification will increase as a deadline on increasing the federal government’s borrowing limit approaches.

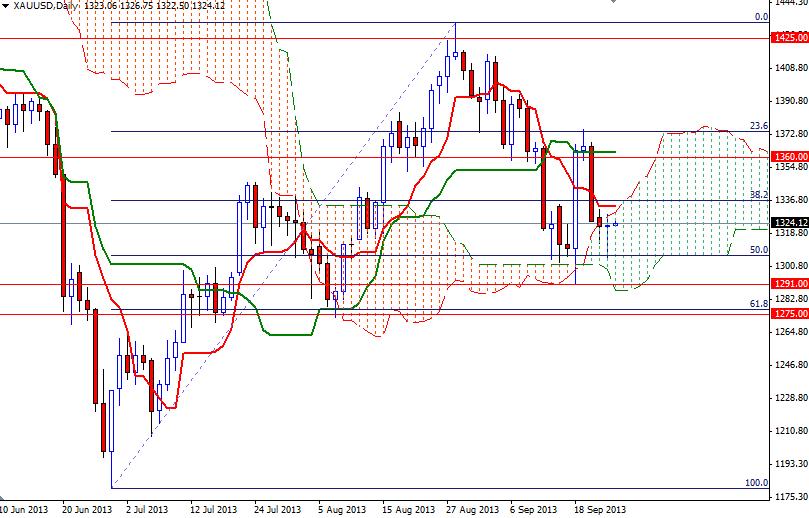

Looking at the daily charts from a purely technical point of view, I see the area between the 1305/2 and 1291 levels has been supportive for the shiny metal lately. Moving inside the Ichimoku cloud on the daily time frame suggests that the XAU/USD pair will be consolidating until the bulls or bears start to dominate the market. In other words, this area (Ichimoku cloud) will decide the direction for this pair for the near term. Because of that, I wouldn't be comfortable going short in this market until prices make a sustained break below the 1291 level or going long until we close above the 1345 resistance level. In the meantime, I will be monitoring the 1333 and 1305/2 levels.

If the American dollar resumes its bullish sentiment and prices close below the 1291 support level, I will look for 1275 and 1269. If the bulls take over and push the pair above 1333, I think we will reach 1345 eventually but again a close above the 1345 is necessary to tackle 1360 and 1380.