Gold continued to lose ground against the American dollar as worries about a potential U.S. strike on Syria eased temporarily. The XAU/USD pair initially fell to a six-day low of 1373.79 before recovering to 1392. As a result the pair printed a hammer on the daily chart. Although this rebound suggests that the bulls are not going to give up without a fight, I think a break above the 1408 resistance level is necessary to confirm this theory.

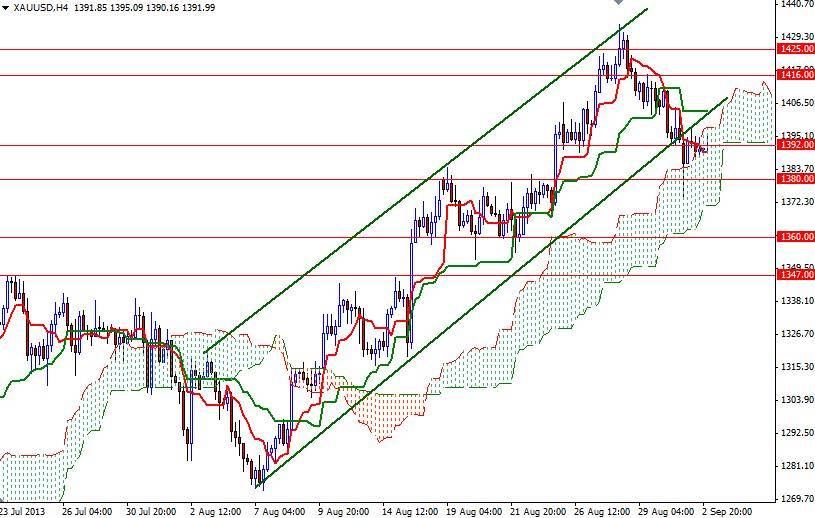

From a technical perspective there are two things to pay close attention. First of all, the XAU/USD pair is trading above the Ichimoku clouds on the daily time frame and that indicates falling prices will find support in the medium-term. The next thing is (again the daily chart) the ascending channel which the pair has been respecting since July. It is quite likely that gold prices will remain within the channel until the market has a clear signal from the U.S. Federal Reserve.

I still think that Fed policy makers could make a small move at this month's meeting unless the official employment data which will be released on Friday are disastrous. During the Asian session, the pair is trading around the 1392 level, broke below a shorter term ascending channel but still moving in the Ichimoku cloud on the 4-hour chart. That means if the bears defend the 1407 level and prices fall below 1380, the pair may gain enough momentum to test 1360, 1353 and 1347 support levels. If prices climb and hold above the 1408 resistance, the bulls may have another chance testing the 1416 - 1425 zone. Beyond 1425, the most important challenge will be waiting the bulls at 1455.