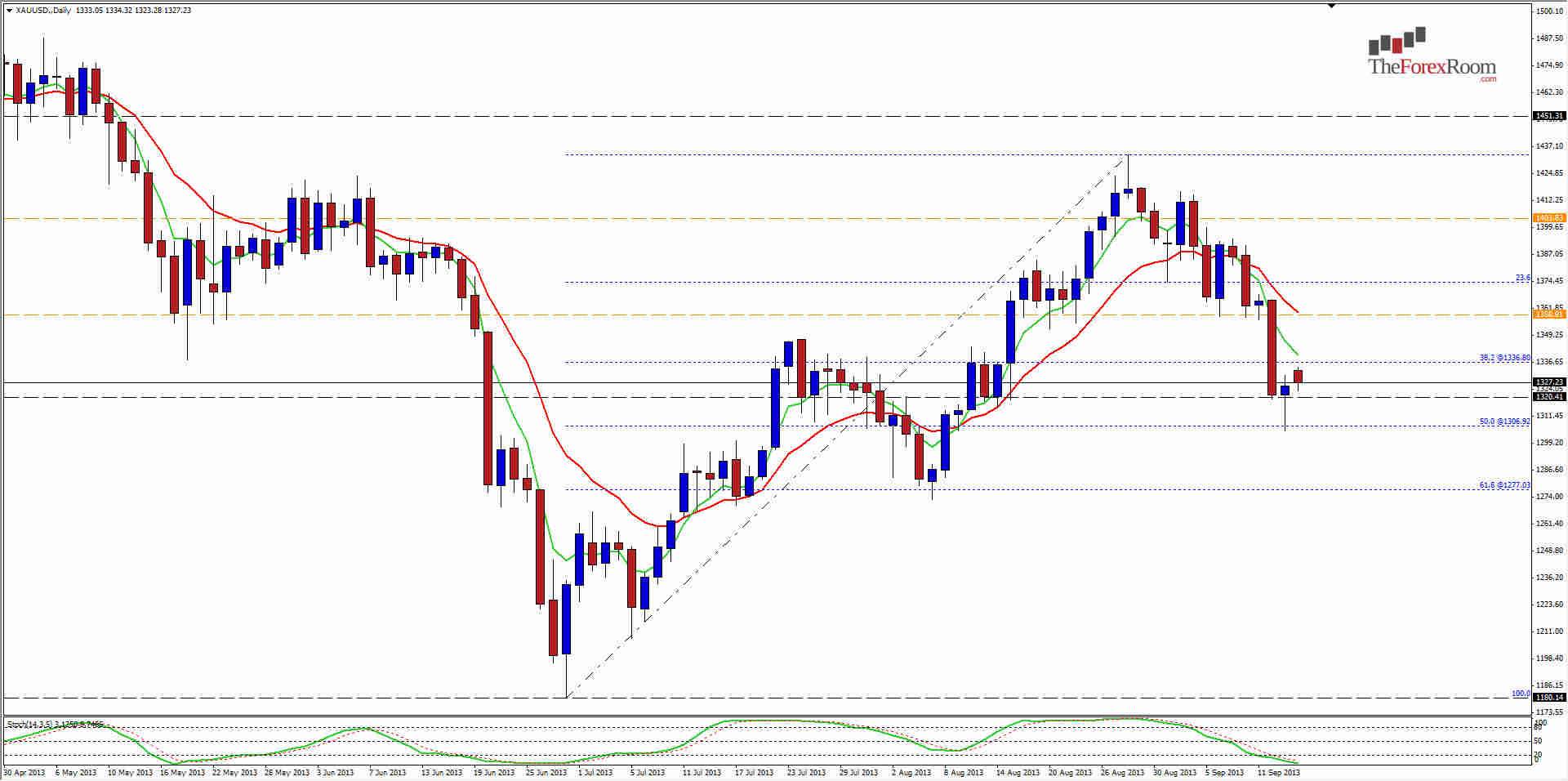

Gold printed a Daily Hammer aka Pin Bar on Friday. It did this off of the 50% Fibo retracement for the most recent move from the yearly low at 1180.28 to the August high at 1433.85. On a daily chart we can see that the pair has bounced from this area twice recently and this could make it 3 times a charm.

Although prices gapped up at the market open, and last Friday’s high has already been broken, it is important to see this happen again when the higher volume sessions begin in Europe and the USA for this trader to get on board. If it does, we can begin looking for targets or resistance at around 1358, 1375 and 1403 on the way up to 1450. Below support is seen at 1306, 1277 (also a 61.8 Fibo) and of course 1180.