By: DailyForex.com

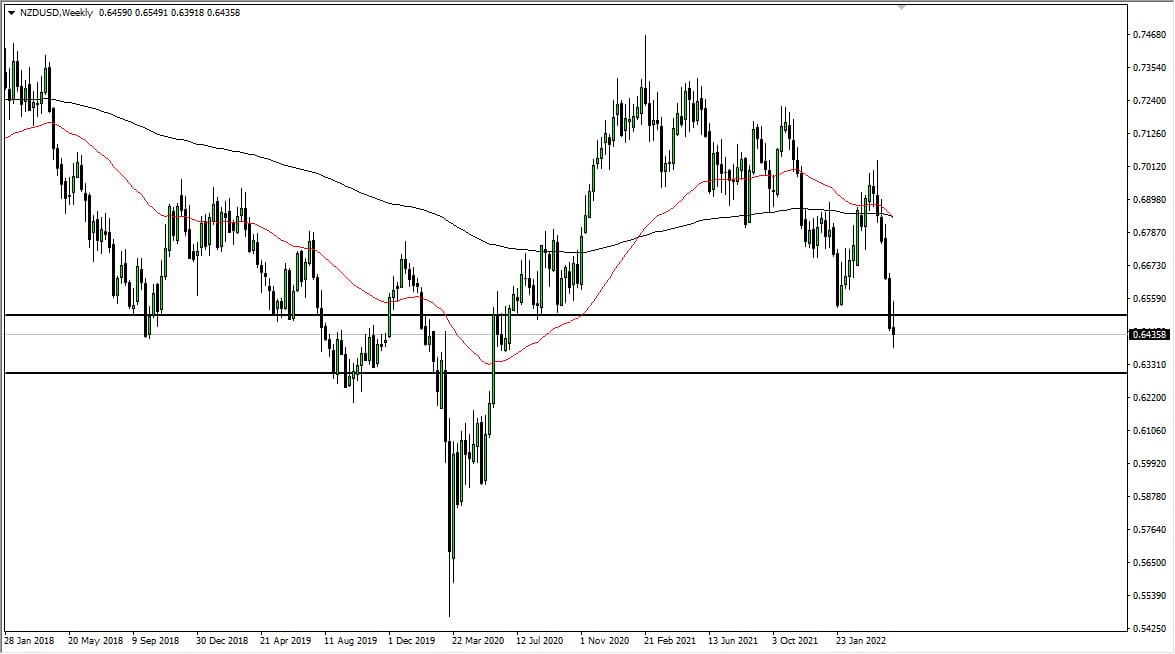

The NZD/USD pair rose during the session on Wednesday, breaking above the short term resistance that we have seen over the last couple of weeks. This is more than likely going to be a bet on what the US dollar is about to do, and almost nothing to do with the New Zealand dollar itself. This is because of the Federal Reserve and its upcoming decision on whether or not to taper off of quantitative easing. If they do, this will drive the value the US dollar much higher, and commodity currencies such as the New Zealand dollar will get absolutely pummeled.

On the other hand, there is the possibility that the Federal Reserve does in fact keep the quantitative easing rates at current levels, and that more than likely will drive the value the New Zealand dollar through the roof as the US dollar would get absolutely pummeled. Commodities of course would rise, and that being the case the New Zealand dollar would get a boost just by proxy.

Headlines will drive this market back-and-forth

Headlines will throw around the value of the New Zealand dollar as traders will try to figure out what the Federal Reserve is about to do. If they continue to inflate away economic problems in the United States, commodities will skyrocket, as they tend to do. Because of this, any chance that the Fed may or may not do something will certainly be reacted to in this market.

With that being said, keep your stops tight as this market will more than likely be erratic. On top of that, the New Zealand dollar is one of the least liquid currencies of the more commonly played markets, and as a result you could even consider the options market for the next two weeks. However, I do feel that ultimately this market will break down, and if we do get below the 0.77 handle, we could see a massive move down to the 0.75 level. I also think that the 0.80 handle will also be very resistive, and a resistive candle up there is more than enough of a reason for me to start selling.