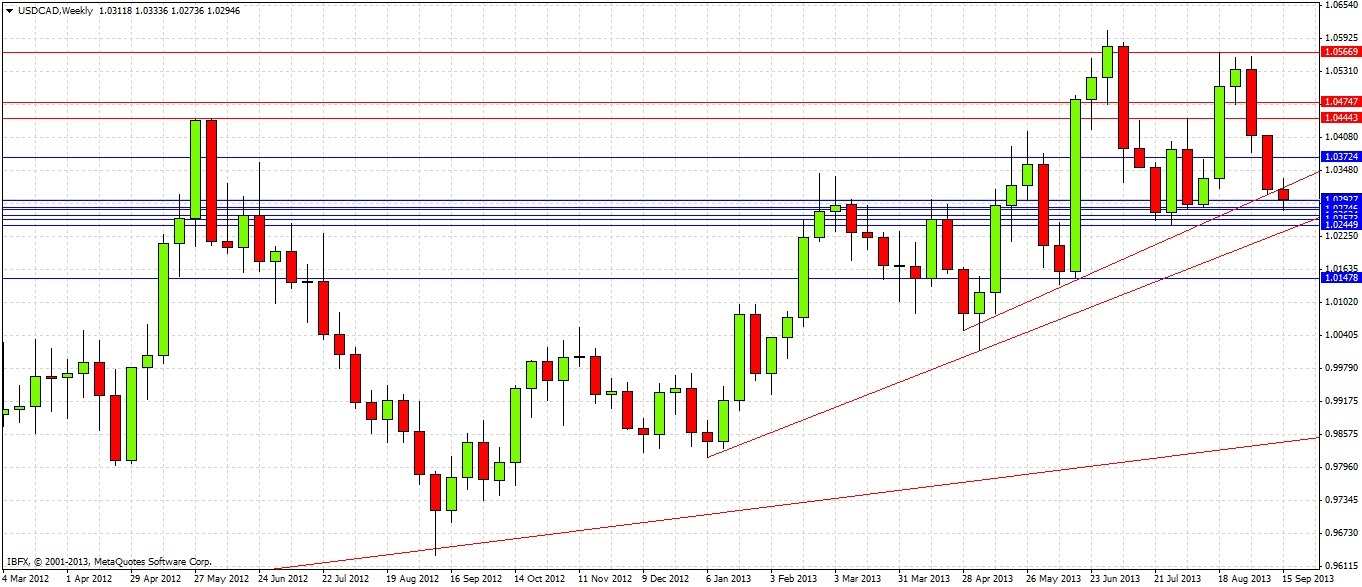

Our analysis last Thursday can be summarized as follows:

1. We are likely to get some kind of bullish rise initially from our touch of the first bullish trend line.

2. There is a bullish trend line just above 1.0300 that is currently acting as support.

3. Below this first trend line, we can draw a second bullish trend line that is currently coming up to just about reach the low of this support zone at 1.0245.

4. It is impossible to predict exactly where in this support zone the price is most likely to turn around, except to say if the price reaches the lower bullish trend line in conjunction with one of the daily (or even better, weekly) lows, this would be an excellent point to look for a long.

5. Nearest reliable resistance overhead is at 1.0475.

6. The best opportunity will probably be a long trade between 1.0280 and 1.0245.

Let's look at the daily chart since then to see how things turned out

It is really too early to judge this prediction, except to say that we did get the small bounce up from the first bullish trend line last Thursday, before gapping below that trend line over the weekend.

Turning to the future, let's start by taking a look at the weekly chart

This does not really add much to the picture, except to show that last week had strongly bearish action and that we are in a zone that acted as support previously over a period of 3-4 weeks.

Let's take a closer look at the daily chart:

The interesting things to see here are that first, we had a move up from 1.0281 to 1.0334: 52 pips. Following that, the price fell again, this time reaching 1.0274 and reaching a high of 1.0302 to date: 28 pips.

The question is whether we have already seen the bottom. If the price now rises significantly without making a new low, then we probably have, or we will have at least probably seen the best of this low. However the lower high suggests that we have not seen the low yet.

If the area from about 1.0245 to 1.0260 is visited soon, this could be the spot from which a major move up will begin.

It is worth holding on to any long trades that you may have entered already. For new longs, it should be best to look at entering between 1.0245 and 1.0260.

It seems unlikely that the long-term low at 1.0245 will be broken meaningfully any time soon.

Bear in mind that there is important USD news tonight that could move the price strongly, price might spike below the support. Stops might need to be widened accordingly.