USD/JPY

The USD/JPY pair continues to do almost nothing. The market is hampered by the fact that there are two central banks at the moment that are trying to keep monetary policy as loose as possible. This of course works against both currencies, and as a result we have a bit of a stalemate. In the end, I believe that the market will rise – but we might be weeks, if not months from that actually happening.

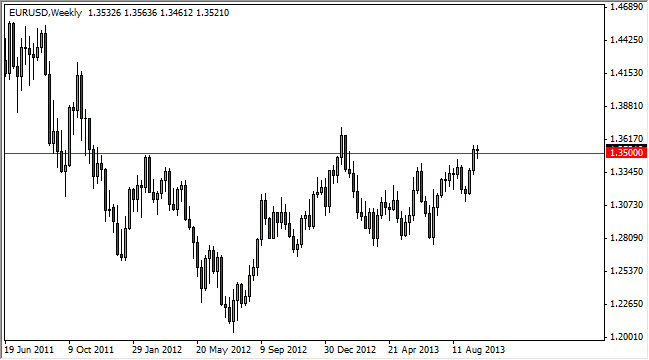

EUR/USD

The EUR/USD pair fell for most of the week, but then bounced back above the 1.35 handle in order to form a nice looking hammer. This hammer of course is positive, and shows that the market is going to go higher all things being equal. I think the Federal Reserve refusing to taper off of quantitative easing this month has put the Dollar on the back foot, and as a result I expect this market to continue to be bought and am going to go long on a break of this candle to the upside.

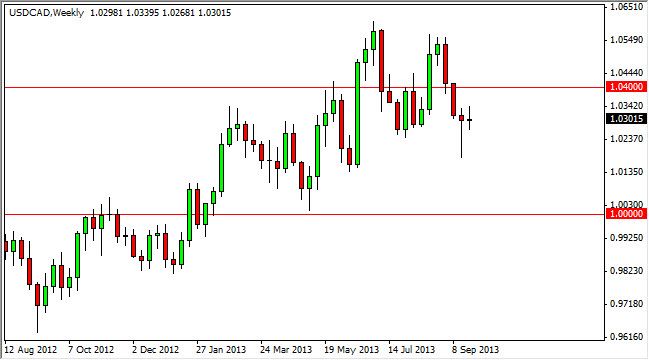

USD/CAD

This pair is one that seems a bit stuck at the moment as well. After all, we had a hammer form the previous week, and now has a neutral candle for this week. This shows a bit of indecision, and as a result this market looks like it is going to be tight going forward, and the 1.04 level looks like it is going to be resistance as well. This should keep a bit of a lid on the market, but I am willing to take a chance on the shorter-term charts. As far as the weekly – good luck.

GBP/USD

The GBP/USD pair continues to look bullish as the past week closed at the very highs. The market has now shown its willingness to stay above the 1.60 level, and I think it is now the “floor” in this markets as well. Because of this, I think pullbacks will be buying opportunities as well, and that the market will in fact breakout to the upside – targeting the 1.65 handle.