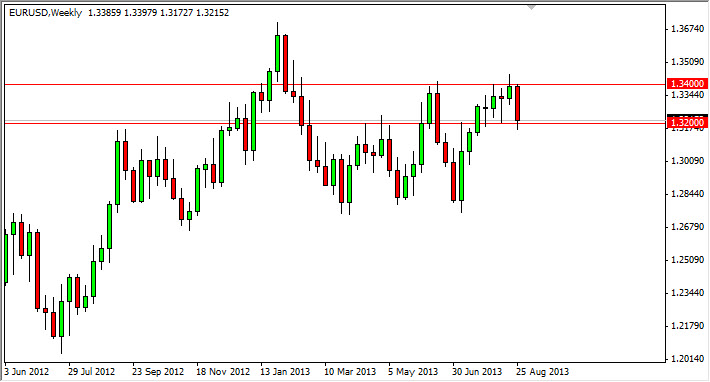

EUR/USD

The EUR/USD pair fell during the course of the week, but as you can see the 1.32 level has in fact held as support. Looking at this chart, I cannot help but notice that there is a ton of support all the way down to the 1.28 handle, so I firmly believe that this pair will find a supportive level between here and there. On top of that, the Federal Reserve and its decision isn't here yet, and as a result I believe that this pair will simply tread water between now and then, as traders try to figure out what the value of the US dollar is going to be. Expect more sideways action.

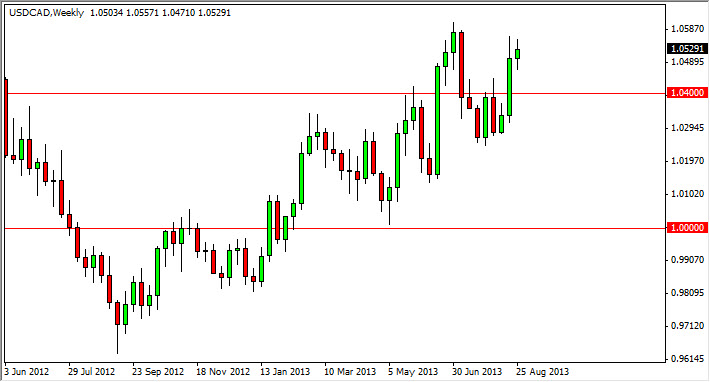

USD/CAD

The USD/CAD pair did very little during the week, as we remain hovering around the 1.05 handle. I believe the real resistance is up towards the 1.06 handle, and as a result this market does not interest me at the moment. However, the oil markets have recently been very erratic, so this could suddenly become an interesting pair if we get that daily close above the 1.06 handle. If we pull back, I believe that the 1.04 handle will be supportive, and I would be willing to buy down there if we do in fact see that support.

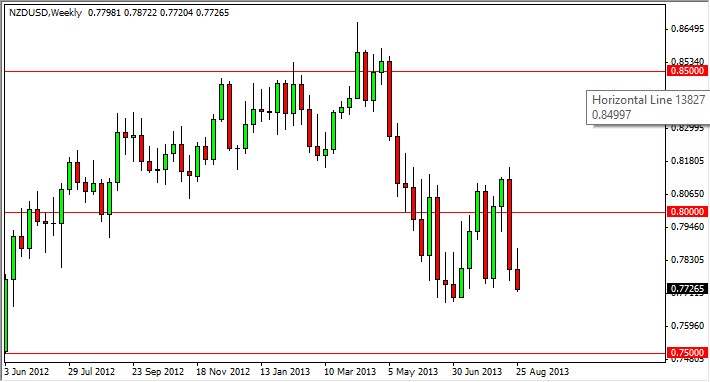

NZD/USD

The NZD/USD pair had a rough week after initially trying to go higher, but running into far too much resistance. The end result is a shooting star the bottom of a consolidation area, and I believe this signals that we are about to start falling again. This is especially interesting considering commodities have been weak the last couple of days, and therefore it makes sense that the New Zealand dollar may soften up. On a break of the lows, I firmly believe that this pair is heading to the 0.75 level.

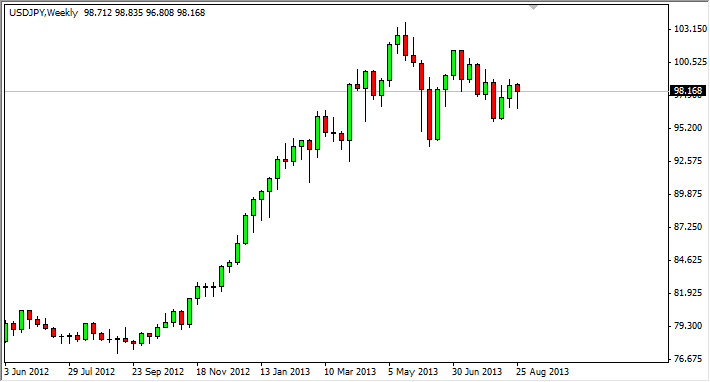

USD/JPY

The USD/JPY pair fell during the majority of the week, but as you can see bounced enough to form a hammer. This hammer is quite telling to me, as I believe every time this pair falls there will be buyers willing to step in. I believe this is a nice long-term move higher, and now that the liquidity should be coming back into the markets over the course of the next couple of weeks, I believe we can make our move higher. Long-term investors are undoubtedly buying at these levels.