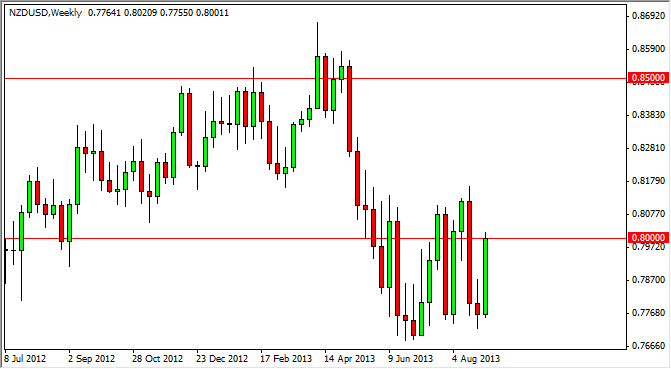

NZD/USD

The NZD/USD pair had a strong showing this past week, slamming into the 0.80 handle. Certainly, the weak nonfarm payroll number coming out of the United States on Friday helped the Kiwi dollar, but if you look at the weekly chart attached to this article, you can also see that we have been in consolidation for some time. I believe that we will eventually see this pair breakout in one direction or the other, but it's all going to come down to the Federal Reserve and whether or not it chooses to taper off of quantitative easing. As this is a commodity currency, you can expect it to react wildly to that announcement. At this moment time though, I believe that the 0.82 level is about as high as this pair gets, while the 0.77 handle offers support.

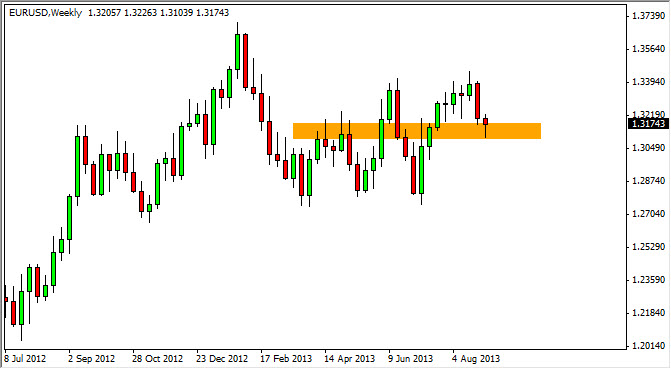

EUR/USD

The EUR/USD pair fell during the course of the last week, but as you can see found enough support to form a hammer. The orange box on the chart shows an area where price has found both support and resistance, and as a result it looks like this market is ready to go higher. In my estimation, this is simply the market suggesting that the Federal Reserve cannot taper off of quantitative easing after the poor jobs report out of America. If we break the top of the hammer, I would suspect that this pair goes to the 1.34 handle.

AUD/USD

The AUD/USD pair had a strong showing as well, but what I find interesting about this chart is that it has been so bearish for so long, you have to ask whether or not we are in consolidation - or accumulation? The 0.90 level certainly is a large psychologically significant number, so to see a bounce from here isn't exactly a stretch of imagination. If this market goes above the 0.93 handle, I believe that we will hit 0.95, and possibly even parity as the market would certainly be shifting momentum to the upside at that point. I also believe that is the Federal Reserve decides that. On the other hand, if we managed to break to fresh new lows, the market should eventually hit the 0.85 level.

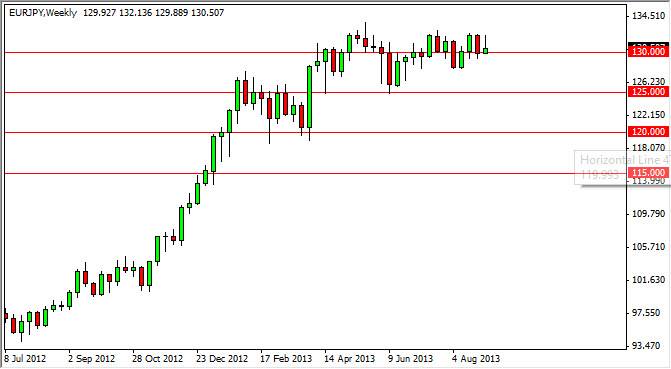

EUR/JPY

The EUR/JPY pair tried to rally for most of the week, but as you can see gave back quite a bit of the gains. The candle of course is a shooting star but it sits right on top of the 130 level, an area that has been very supportive lately. The shape of that shooting star suggests that perhaps we will go through the support area, but there is also significant support at the 128 handle, and most certainly at the 125 level. That being the case, I believe that waiting for this pair to pull back slightly in order to form a supportive candle will be the way to go forward.