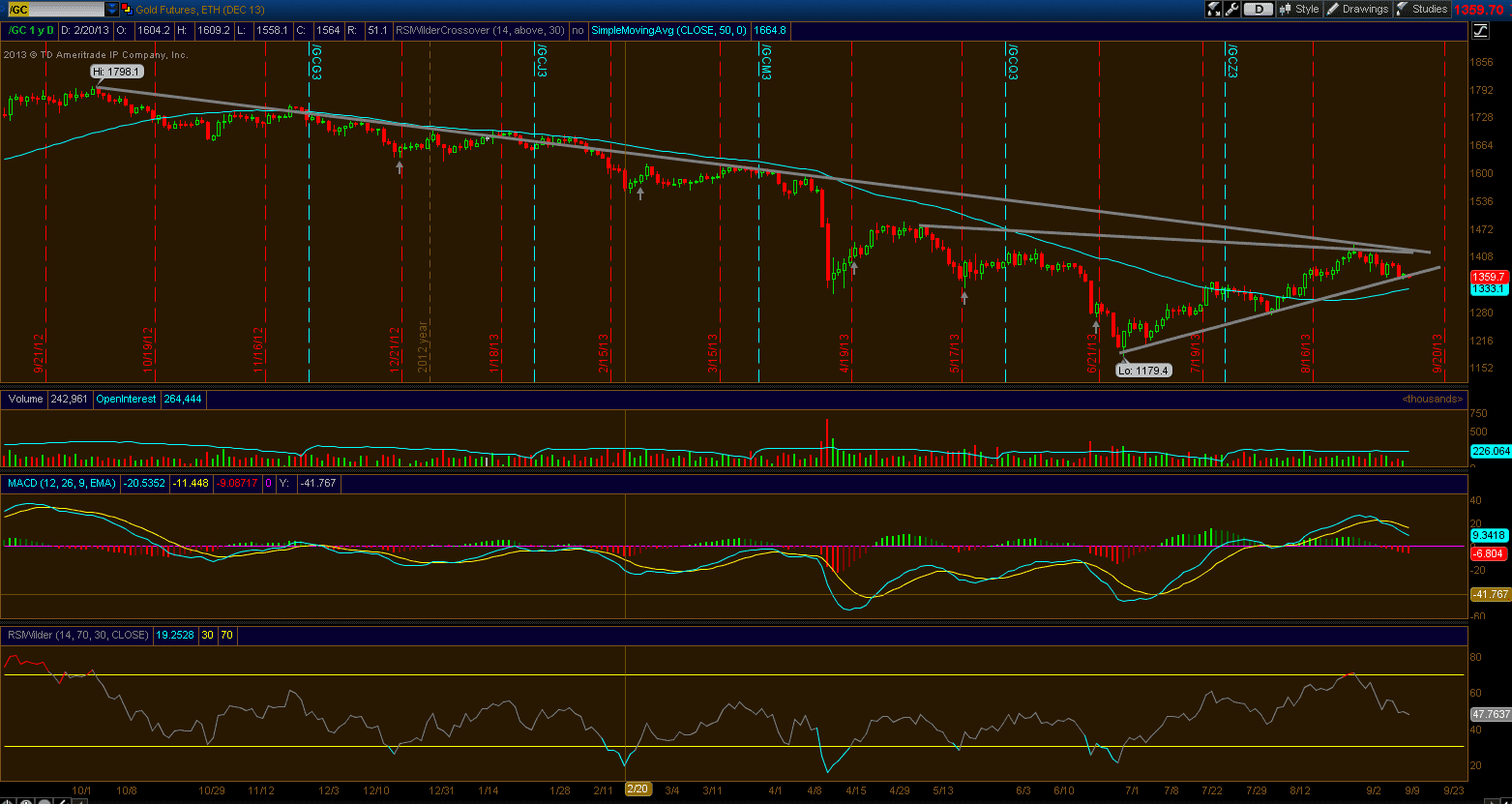

Gold has had some wild Macro swings lately, between the Fed “Taper” and Geo-Political issues with Syria. Concentrating on the Technicals, the Precious metal is an important decision phase. Down from 1417, Gold Futures are still holding an upward trend, as well, looks to be on the bottom end of that trend and looking for a bounce.

This trend is also towards the end of longer term triangle pattern, and looking for a break-out soon, up or down. Support here is Tuesday’s low of 1356, which also seems to be where it’s 50 day is starting to come into play, currently at 1333, and looking to be reversing trend to the upside. If we do crack this current uptrend on the down side, 1347 is previous resistance, then would look to 1280 (Support from 8/7), then further out to 1200, which was the level that started the current 3-month rally, and a 3-Year Low. MACD and RSIwilder both do not look to be on Gold’s Bullish side, both making extended tops and reversals in August.

These indications are pointing to overbought levels trending towards oversold, and would need the price to find support here at 1350-1360, or the selling trend should continue, and as well speed up towards a level of capitulation. I am a longer term Gold holder (via $GLD), and am still holding to my overall bull thesis. I do think the Technicals could be in trouble in the shorter term, but if we hold these levels, Gold should retest the 1410 level. If can break there, Strength and Moving averages could turn quickly. Above 1410, upside levels could test 1480, and further out to 1600.

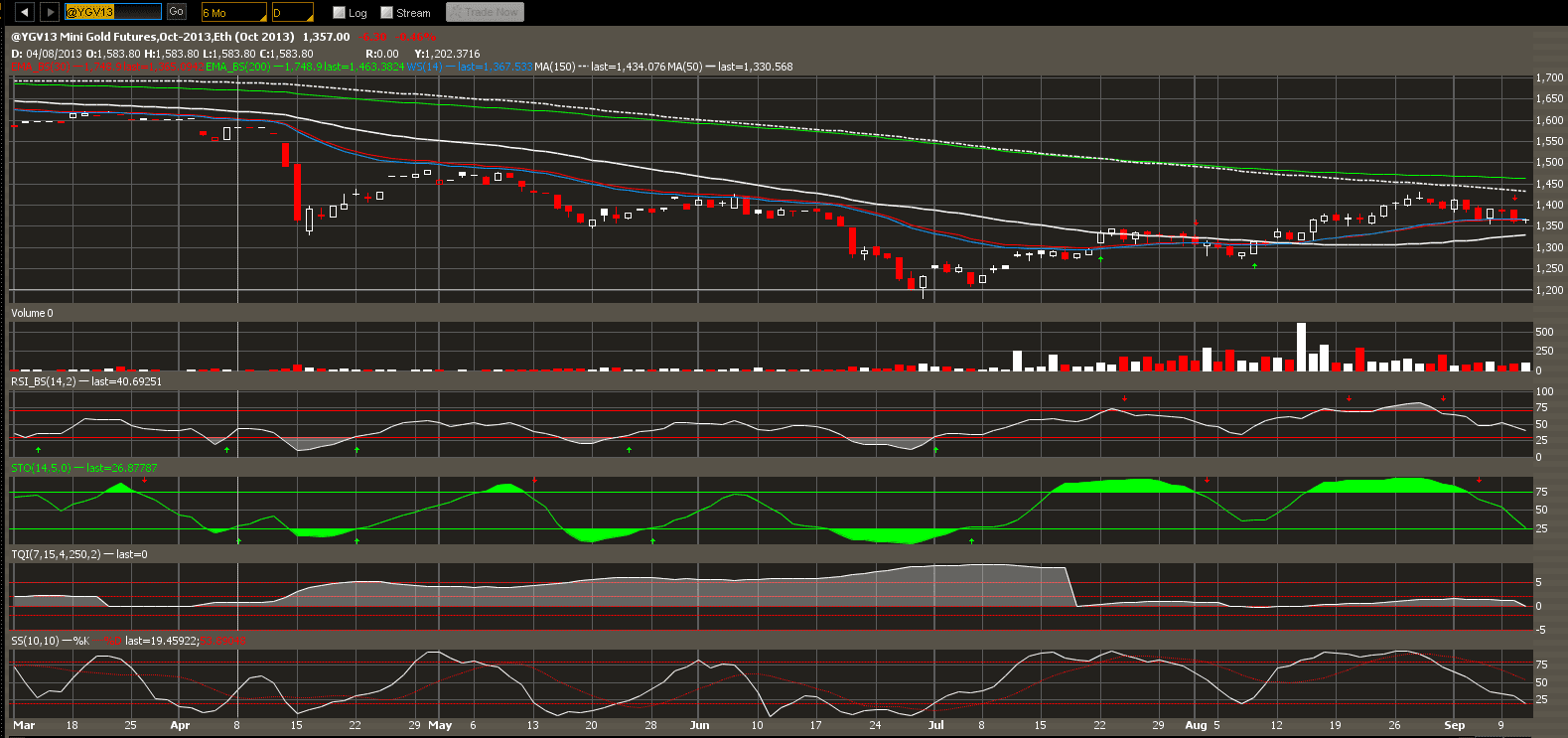

Looking at Futures for October, a similar picture is represented where the price action is on important support, and the technical indicators are in a bearish trend. They have spent some time on this trend, so could be due for a reversal, but definitely need the price to hold soon and bounce. The futures are sitting right on their 14 & 30 Day support levels, and still have some work to do to get back to their 150 day. That 50 Day does look to be reversing to a bullish trend, and can also see a lot of buying volume at the 1300 level, where this 50 day seemed to begin holding a bottom.