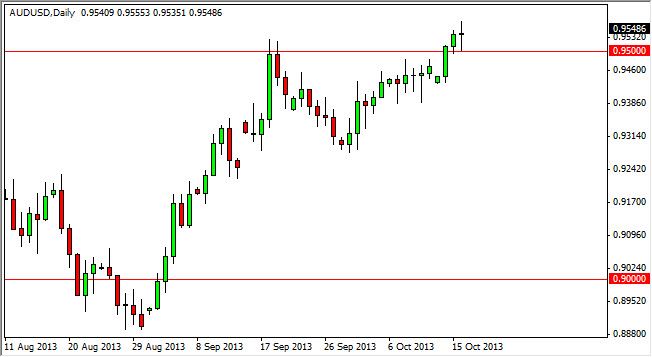

The AUD/USD pair went back and forth during the session on Wednesday, but ultimately finished the day unchanged. The most important thing about the candlestick though was that it showed that the 0.95 level did in fact offer support. Because of this, I believe that this market has proven that the previous resistance area is support, and as a result we are free to go higher. On a break of the top of the range for Wednesday, I think markets will really start to pick up momentum to the upside.

Because of this breakout, I believe that eventually this market will head for parity, as it is the next obvious large round psychologically significant area. However, no market moves in a straight line, so pullbacks can and will happen. In fact, I believe those pullbacks will offer buying opportunities, so looking at short time frames in order to get involved, might be the way to go.

Federal Reserve and tapering

A lot of this market will be determined by whether or not the Federal Reserve can taper off of quantitative easing. That being the case, I feel that the markets will pay attention to whether or not the jobs number comes out strong in America, and if it does not the US dollar will get pummeled. As a result, expect the gold markets to go higher, which of course drives the Australian dollar higher over time. As the two markets tend to follow each other over the longer term, I think that a move up to parity makes a lot of sense.

Even if we did pullback below the 0.95 handle, I see a ton of support all the way down to the 0.93 handle, and as a result it's almost impossible to short the Australian dollar. Quite frankly, the only thing that I can think of that would drive this market down is if the jobs number in America came out strong enough to make people believe that the US dollar would in fact gained strength due to tapering out of the Federal Reserve. Quite frankly though, I do not see that happening anytime soon.