The CAD/JPY is apparent that a lot of traders overlook, and to their own detriment. This is because of the basic fundamentals in this pair being so clear-cut. Quite frankly, it has to do with oil. When you look at the basics, you understand that the Canadians export oil, while the Japanese import 100% of their petroleum. This is why the Fukushima disaster happened, the Japanese simply have to find energy any which way they can, as there really isn't much in the way of natural resources that they can utilize.

In this scenario, it's easy to see that the energy markets have a great effect on this particular currency pair. On top of that, you can also make an argument for the difference between the two central banks, as the Bank of Canada is pretty much on hold, while the Bank of Japan looks to expand its quantitative easing over the longer term. After all, the Japanese are just now starting to get aggressive with their quantitative easing, and as a result I believe that the Japanese yen will eventually weaken over the longer term. While it may not do so against the US dollar as much is other currencies, the Canadian dollar has the added benefit of being a petrocurrency.

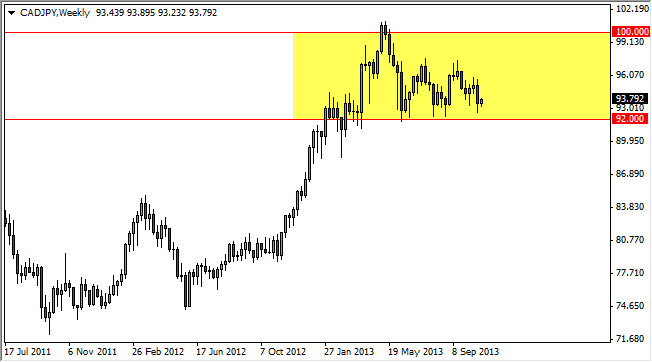

92 is just the beginning.

While I have the 92 level marked on this chart, quite frankly I see support going all the way down to the 88 handle. Because of this, I am looking for some type of supportive weekly candle in order to start buying, or a shorter-term supportive candle closer to the 92 handle. I believe that there is 400 pips of support below, and therefore even if this market starts to fall early in the month, I believe by the time the end of the month comes, we want the very least be back to the 96 handle. Quite frankly, if oil markets make a move, this market should go back up to the 100 handle. It will more than likely be in tandem with the USD/JPY pair, but remember that this pair does not necessarily have to move at the same rate, and can often outperform that market.