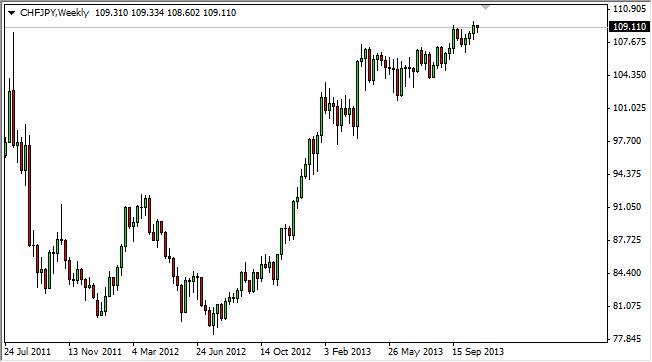

The CHF/JPY pair is one that a lot of you will overlook, but it is very interesting for several different reasons. Number one, it tends to trend for great lengths of time. After all, both of these are considered to be "safe haven currencies", and because of that a lot can be learned from simply watching the trend.

For example, looking at this chart over the last year and a half, you can see that the Swiss franc has been favored over the Japanese yen. In other words, if you are looking to sell a safety currency, you will want to sell the Yen over the Franc. So for example, if you decided to play a high alpha currency pair, you might consider buying NZD/JPY instead of NZD/CHF, simply because it should move much farther based upon the relative weakness of the Japanese yen in relation to the Swiss franc.

Long-term play

The fact that this market has recently broken above the significant high back in June of 2011 suggests to me that we are definitely going much higher. Don't expect fireworks, because this pair typically doesn't shoot straight up or down, it's more of a grinding type of market. Because of this, it's best to think of this market as an investment.

I believe now that we clear that level, the 110 handle will be the next significant resistance. That will be resistance in name only, because it is a large round psychological number, not actual technical resistance. In other words, I fully expect to see this market continue to grind higher, probably for the next several months, if not years. With that being the case, a lot of money could be made by playing small positions and adding to them every time we get a short-term pullback.

Quite frankly, I don't see any chance of this pair break down, simply because there is such a large cluster of support below the 107 level. This is probably one of the safest currency pairs right now to trade, which is something that I never say.