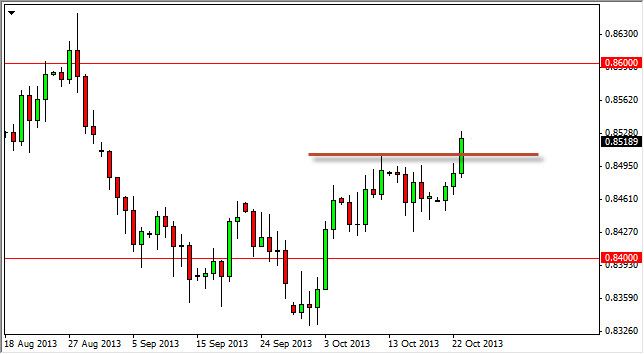

The EUR/GBP pair rose during the session on Wednesday, breaking above the 0.85 handle, an area that I've been talking about for some time now. By closing above the 0.85 handle, and now feel comfortable enough to start buying this pair on pullbacks, or simply a break above the highs for the session. This is simply because the Euro does look strong overall, and this pair seems to be entering a previous consolidation area that goes up to the 0.86 handle. Because of this, I feel that we will eventually try to get up there, and should succeed simply because of the nature of Forex markets to go from one major area to the next.

Obviously, the 0.86 level is a somewhat psychologically significant number, not to mention the fact that the area has been resistance before, last seen in August. This is a phenomenon known as "market memory", and as a result we should see sellers in that region. The question then becomes whether or not they will be enough to keep the market down, and quite frankly I think that's probably true as both of these currencies are doing fairly well against the US dollar.

Not all trades can be homeruns, slam dunks, or even stellar goals.

This is one of those trades that will be more or less for short-term traders, and as a result it should be thought of more as a simple gift that the market is giving you, not some type of massive account building a situation where there will be a ton of money to be made. Truth be known, this is the more common type of trade, one that simply gives up about 80 pips or so.

That being said, I do believe that the area just below current trading is supportive, simply because it is so noisy. That noisy area should continue to offer support going forward, and as a result I feel that any pullback that produces a supportive candle is also a nice buying opportunity in the near-term as this market continues to find its footing.