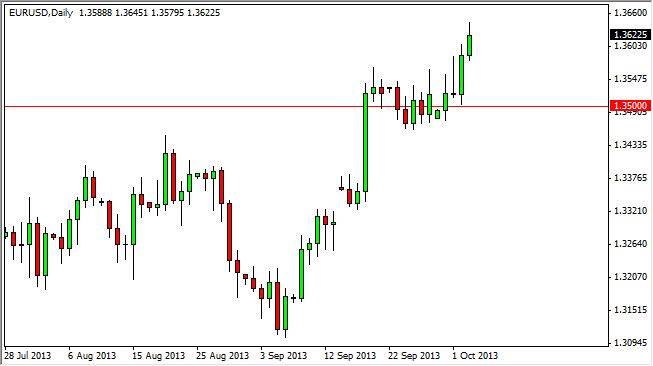

The EUR/USD pair rose during the session on Thursday, breaking above the 1.36 handle finally. Now that we are above there, looks like this market certainly is biased to the upside, and with the nonfarm payroll numbers coming out later today it's very likely we could get a large move. However, it's also possible that we get a bit of a shock, and that of course can put the markets into complete disarray.

With the Federal Reserve waiting to find out what the employment data looks like in order to decide on tapering off of quantitative easing, this jobs number will be very important. That's because it will help the markets get an idea of how long it's going to be before the Federal Reserve can possibly make that decision. After all, tapering off of quantitative easing would be very good for the dollar. And that particular scenario would certainly have this pair falling.

Europe is looking stronger.

Europeans do look a bit stronger these days, exiting recession. That being the case, it makes sense of the Euro would appreciate against the Dollar anyway, especially considering that the Federal Reserve looks like it's got its hands tied. If that's the case, then we should see continued dollar weakness for some time, and this could finally be a currency pair that's trending with some type of certainty.

I believe that this nonfarm payroll number coming out today will be a fairly significant one as it will let us know whether or not tapering is even going to be possible between now and the end of the year. As the data keeps coming in, is looking less and less likely the tapering will happen before 2014, and possibly even later than that the way things been going. As far as this pair is concerned, it makes sense for it to continue to go higher based upon those ideas.

This isn't to say that the market will fall, it very well could. However, I believe that the 1.35 level is going to serve as a "floor in this market", and as a result anything down there that looks supportive is probably a buying opportunity as well.