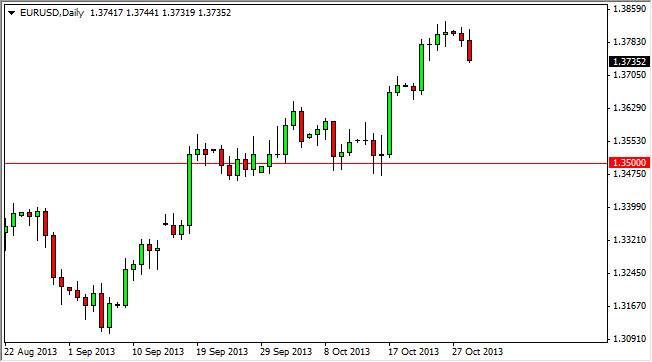

The EUR/USD pair tried to rise during the Tuesday session, but as you can see failed to hang onto gains. The resulting candle ended up being fairly negative, and because of this I feel that this pair has a bit of weakness in the short-term coming, simply because the market had gone so far to the upside in such a short amount of time. The market needed to pull back and calm down, and this is the natural reaction of a market that has been so bullish as it needs to “breathe” for a moment.

The market seems to have a nice cluster below at the 1.37 level that could be supportive in the meantime, and this is about as far as I expect to see the market fall at the moment. However, the real “floor” in this market is at the 1.35 level as far as I can tell, so we could in fact fall that far and I would still think of this as a bullish market.

The Federal Reserve and jobs in America

The Federal Reserve has been debating whether or not to taper off of quantitative easing for some time now, and the one thing that the members of the FMOC agree on, is the fact that the jobs market in the United States needs to improve before tapering is a viable option. This being said, it appears that the markets are going to focus on the Non-Farm Payroll numbers much more than they had over the course of the last few years. In fact, this will be the only real question: Is the Federal Reserve able to taper? If so, then you will see the value of the US dollar go much higher. However, I think we are several months away from reaching that point.

I still believe that the Euro will hit the 1.40 mark before the end of the year, and quite frankly think it could come much sooner. With this being said, I am bullish of this market and simply waiting for this pullback to run out of strength, and will be buying the first supportive looking candle on the daily close that I see.