The gold market appears to be stable with the bulls and bears gaining and losing ground almost equally during yesterday's session. Finally U.S. Senate leaders came up with a deal to raise the debt ceiling and end the government shutdown. Although this last minute deal which raises the borrowing limit through February 7 and funds the federal government until January 15 created a sense of relief in the markets, it does not resolve the long-term debt problems of the world's biggest economy.

That means we are going to watch the same political drama again. In the latest economic data, The National Association of Home Builders' sentiment index came in at 55, down from the previous month's 57 and below expectations for a reading of 58. I think the recent price action reflects that desire to buy gold as a hedge against financial turmoil has diminished. It seems that heightened appetite for more conventional assets, such as stocks, as well as a growing conviction that the Fed will be able to shrink its ongoing asset buying program at some point could limit gold’s potential upside.

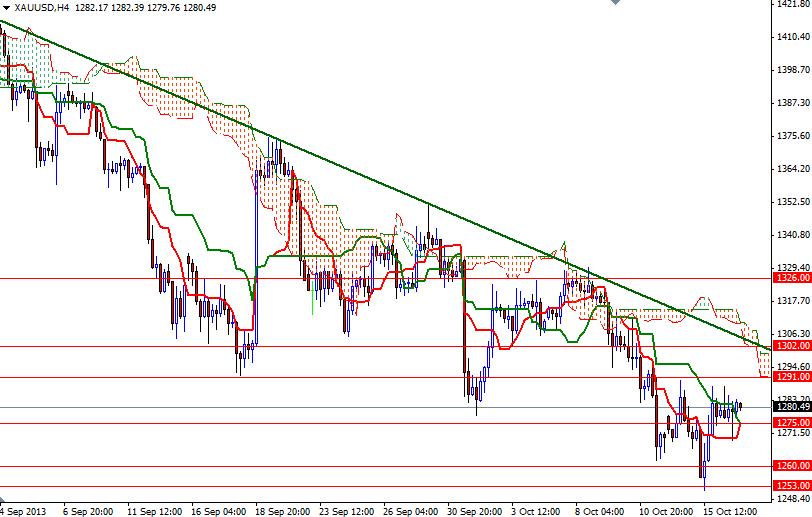

On the weekly time frame, gold prices are below the Ichimoku cloud and that means there is more resistance to the upside. On the other hand, the average cost of gold production is much higher than 5-6 years ago so expecting prices to fall below $1000 wouldn't be realistic. Because of that, I think the XAU/USD pair will spend several weeks between the 1484 and 1150 levels. From an intra-day perspective, there will be resistance between 1291 and 1302.

Only a close above this level could make me think that the bulls are strong enough to tackle the 1326 barrier. Beyond that, the next challenge will be waiting the bulls at 1345. If the bulls run out gas and fail to penetrate the 1291 - 1302 zone, the 1260 support level will be the key to the downside. Breaking below this level would indicate that the bears will continue to dominate the market. If that is the case, expect to see some support at 1253 and 1245.