The XAU/USD pair rose for the week settled at $1351.54 an ounce on Friday as a series of economic data out of the world's largest economy disappointed the market and continued to weigh on the American dollar. Although the pair initially pulled back and traded as low as 1336.53, prices turned north after the University of Michigan reported that its consumer sentiment index declined to 73.2 from 75.2 and the Commerce Department's figures revealed that core durable goods orders decreased %0.1.

Looking forward, market participants will turn their focus to the Federal Reserve's two-day policy meeting which starts on Tuesday. Although some officials had voiced concerns over the potential risks and costs of purchases, recent reports show the U.S. remains vulnerable to a slower economic growth performance. Because of that, I think chances that the Fed will wind down the quantitative easing program in the next few months have diminished greatly. This should be supportive for gold but persistent rally in equities may dull the shiny metal's attractiveness.

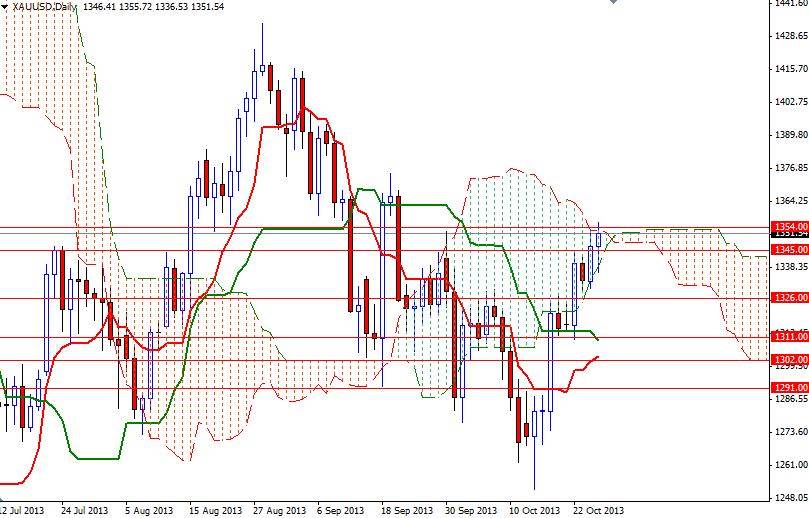

Technically, the Ichimoku cloud indicates a good area of support or resistance depending on its location therefore climbing above the cloud (the daily chart) would be highly positive. If prices continue to rise and hold above the 1354 resistance level, the pair will most likely be heading towards the first barrier at 1366.

Breaking the 1366 level would make me think that the bulls are strong enough to test the September 19 high of 1375.20. If the USD bulls regain their strength and prices turn south, expect to see some support at 1345, 1335 and 1326. A break below 1326 would indicate that the bears are aiming for 1311.