The XAU/USD pair (Gold vs. the American dollar) closed yesterday's session with a loss as the American dollar gained some strength ahead of the outcome of the Federal Reserve policy meeting. Lately, the belief that the U.S. central bank will have to maintain its massive bond-buying stimulus program has been supportive for gold but it appears that expectations of a dovish policy outlook by Fed is already priced in.

In the latest economic data, The Conference Board’s consumer confidence index came in at 71.2, down from a revised 80.2 in the prior month and below expectations for a reading of 75.2. The S&P/Case-Shiller index of property prices was stronger than anticipated but retail sales and producer price index were short of expectations. The mild disappointments in U.S. data failed to have a lasting impact on the American dollar and I think that is something to pay attention.

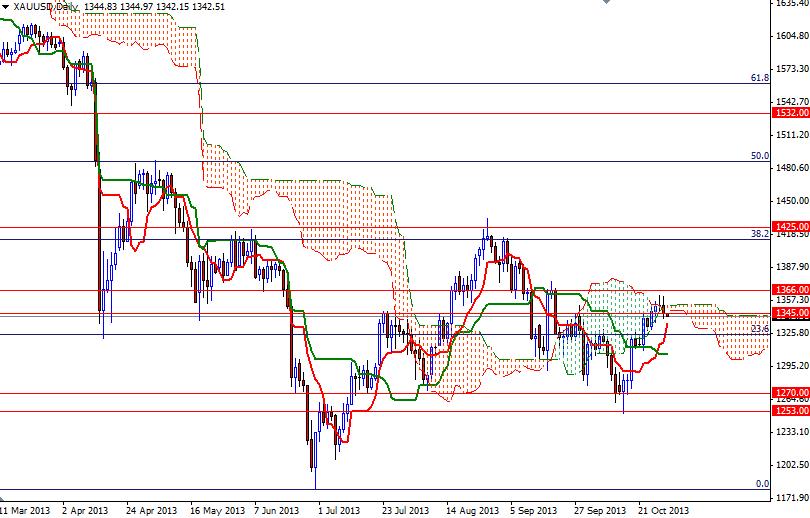

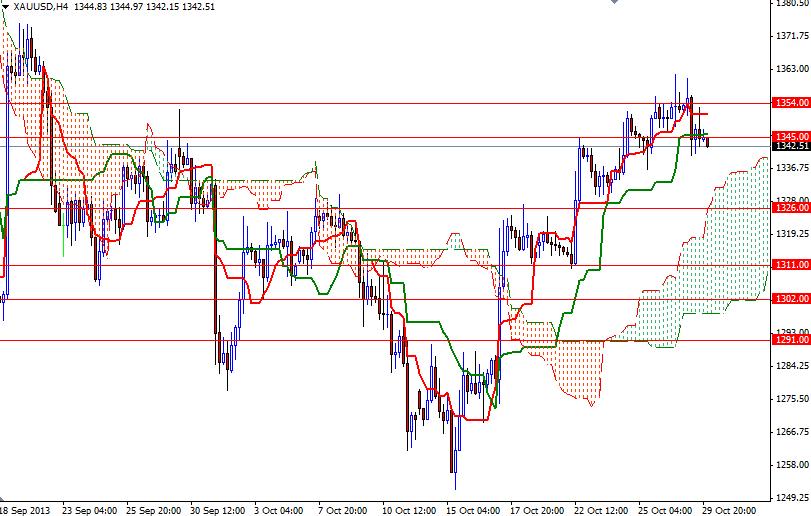

As I mentioned in my previous analysis, closing below the 1345 support might trigger some more profit taking. Now we are back below that level and if the bears continue to dominate gold prices, I think we will see 1335.92 printing on the charts. Breaking below the 1335.92 level, which happens to be the Tenkan-sen line (nine-period moving average, red line) on the daily time frame, would make me think that we are heading back to the 1326 level.

To the upside, the bulls will need to break through the 1354 resistance level in order to gain more traction to reach the 1366 and 1375.20 levels. Beyond that, the bears will be waiting at 1380 and 1392.