Although the XAU/USD pair traded as low as 1302.04 during yesterday's session, dull economic numbers out of the United States and lack of progress on the U.S. budget and debt ceiling discussions helped gold bulls to defend this critical support level. In the latest economic data, the Institute for Supply Management's non-manufacturing index came in at 54.4, down from the previous month's 58.6 and below expectations for a reading of 57.2.

While the American dollar stays under pressure as a deadline on increasing the U.S. government’s borrowing limit approaches, gold investors continue to monitor the health of the economy. Disappointing figures increase the chance that the Federal Open Market Committee will decide to delay tapering its quantitative easing program at its October 29-30 meeting. There are rumors that House of Representatives Speaker John Boehner won't allow a catastrophic default but he will play the budget card to force the White House to accept deeper spending cuts.

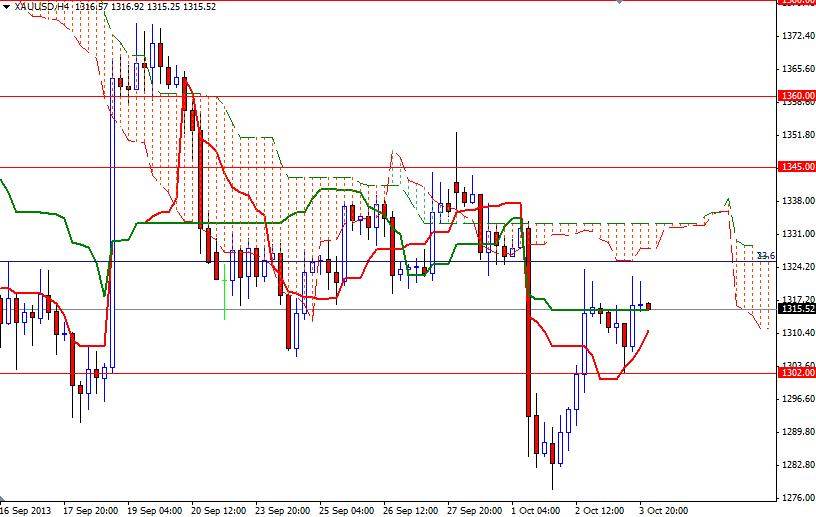

Looking at the daily charts from a purely technical point of view, the odds favor a range bound movement. Prices are moving inside the Ichimoku cloud on the daily time frame and we are stuck in the 1345 - 1275 zone. The XAU/USD pair had spent some time in this area during July and August. With that in mind, I think it makes more sense to wait until we break out of this consolidation box. If we can successfully break through the 1321 level, it is quite possible that the XAU/USD pair will head towards 1345.

On its way up, there will be resistance at the 1334 level where the Ichimoku cloud (4-hour chart) and the descending trend channel coincide. To the downside, the first important support is located at 1302. If gold prices break below that level, the market will probably test the 1291 and 1275 supports. A daily close below the 1275 level could act as a confirmation that the momentum is once again turning strongly bearish.