Signs of progress in resolving the U.S. budget crisis increased demand for the American dollar and lured investors away from the precious metal. There are rumors that Democrats and Republicans were nearing a deal to end a partial government shutdown and suspend the debt ceiling through February 2014.

Although the XAU/USD pair initially traded as high as 1290, the settlement price was below the 1275 level. It appears that investors are showing no love for the shiny metal recently so until the bearish technical outlook changes signs of weakness are what I am looking for. In the meantime, I will also keep an eye on the major stock markets. If stocks extend their gains, there will be even less reason for investors to buy gold.

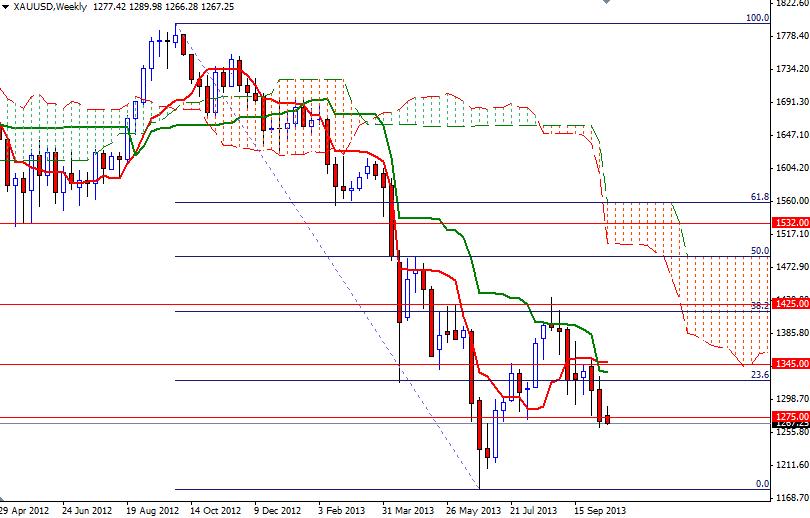

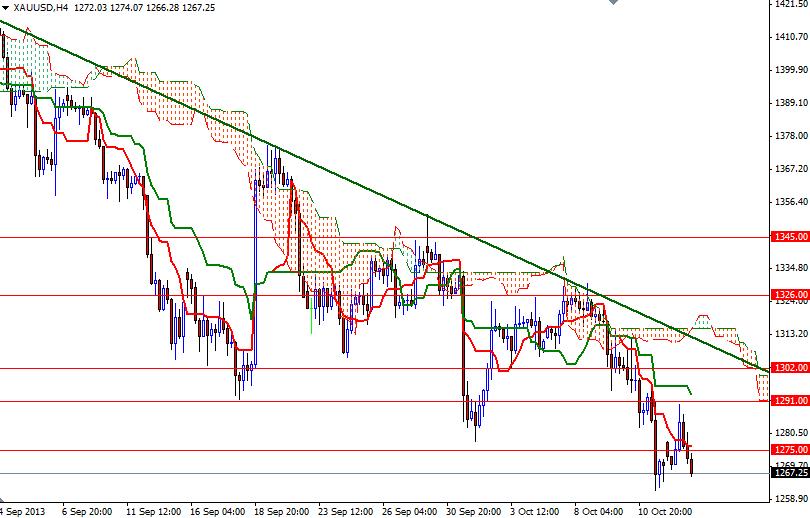

From a technical point of view, trading below the Ichimoku clouds on the daily and 4-hour charts is highly negative for the pair. Because of that, I will be watching the 1260 support closely. If the bears continue to dominate prices and this support gives way, I will look for 1253 and 1245. To the upside, there are several hurdles but in case of a reversal, the first challenge will be waiting the bulls at 1291. If prices break above this level, we could possibly see the bulls make a run for the 1302 level which happens to be the bottom of the Ichimoku clouds on the 4-hour time frame.

The trend line that has been creating a constant pressure on the market since the early part of September also coincides with that level. A close above the 1302 - 1313 resistance zone would signal that the pair is most likely headed for the next strong resistance levels at 1326 and 1345.