Gold prices (XAU/USD) settled slightly lower after a highly volatile trading session yesterday. Although the XAU/USD pair traded as high as 1359.50 after the ADP Research Institute reported that private sector added just 130000 jobs in October, less than expectations of 151000, Fed's policy announcement pushed prices below the 1345 level. The Federal Open Market Committee said “The Committee sees the improvement in economic activity and labor market conditions since it began its asset purchase program as consistent with growing underlying strength in the broader economy. However, the Committee decided to await more evidence that progress will be sustained before adjusting the pace of its purchases.

Accordingly, the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month” at the end of a two-day meeting. It seems that market participants were expecting a more dovish statement from the U.S. central bank.

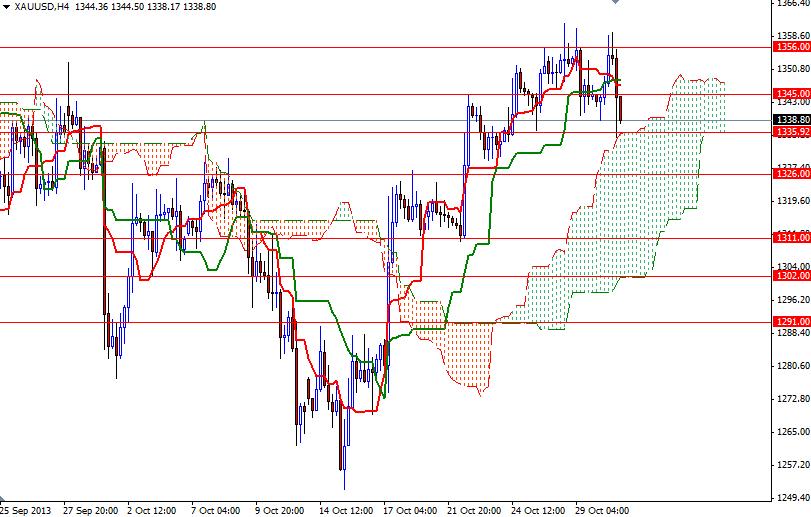

From a technical perspective, failing to close above the Ichimoku clouds on the daily time frame (and also printing lower highs and lower lows) three days in a row indicates that the bulls are running out of fuel. If the bears increase the pressure and manage to drag prices below the 1335.92 level where the top of the Ichimoku cloud resides (4-hour chart), it is likely that the pair will test the 1326 support next.

A close below 1326 would suggest that we are heading towards the 1311 level. However, if the XAU/USD pair manages to hold above the 1335.92 level and starts to climb, the first challenge will be waiting the bulls at 1345/8. Beyond this level, there will be resistance at 1356. Only a close above 1356 could give the bulls the extra strength they need to reach the 1366 level. Today, the market's focus will turn to the weekly unemployment claims and the Chicago PMI data.