The XAU/USD pair (Gold vs. the American dollar) scored a gain of 0.93% on Monday as continuing concerns over the partial Federal government shutdown and the borrowing limit lured some investors to relative safety of the precious metal. The debt ceiling will be reached in less than two weeks and the markets are becoming nervous as time is running out for any compromise solution.

Global equity markets are suffering and the currency market maintains negative view for the American dollar. I think the uncertainty may increase gold's attractiveness as a safe-haven asset in the short-term and prompt funds to get back into gold. As for Fed's tapering, it still depends on economic data so I don't expect any major policy changes at its next meeting. Fed policy makers will probably reiterate that the U.S. economy still needs the support of a very accommodative monetary policy.

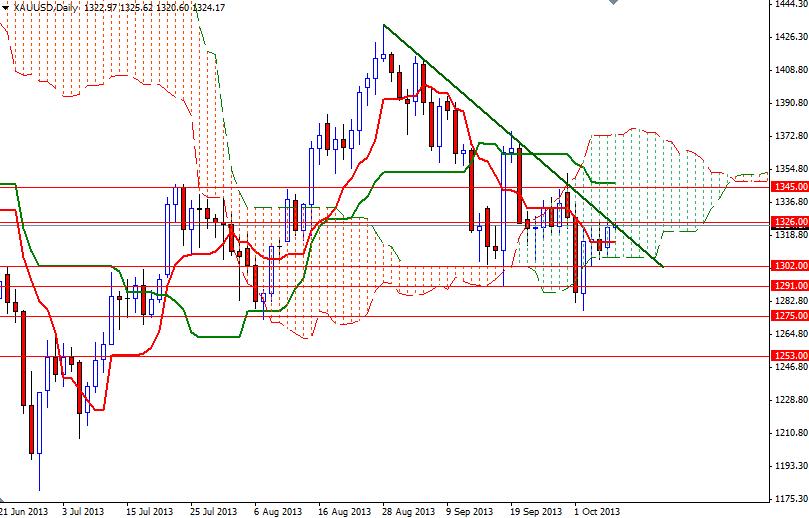

Technically speaking, the daily chart indicates that there is an intense battle going on between the bears and the bulls. Basically, the overall trend is up when prices are above the cloud, down when prices are below the cloud and flat when they are in the cloud itself. However, we have a bullish Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-day moving average, green line) cross on the 4-hour chart and the pair is trying to break above the descending trend line dating back to the August 28 high of 1433.70.

If the bulls take the reins and push the pair above the 1326/33 resistance area, we may see another attempt to test the 1345 level. Since the 1345 level blocked their way several times in the past, the bulls will need to increase buying pressure and break through that barrier in order to gain more momentum. Beyond that level, resistance can be found at 1360 and 1380.

To the downside, expect to see support between 1306 - 1302 where the bottom of the cloud currently resides. If this support gives way, 1291 and 1275 might be tested soon after. A daily close below 1275 would shift things to the bears and increase speculative selling pressure.