By: Matt Fanning

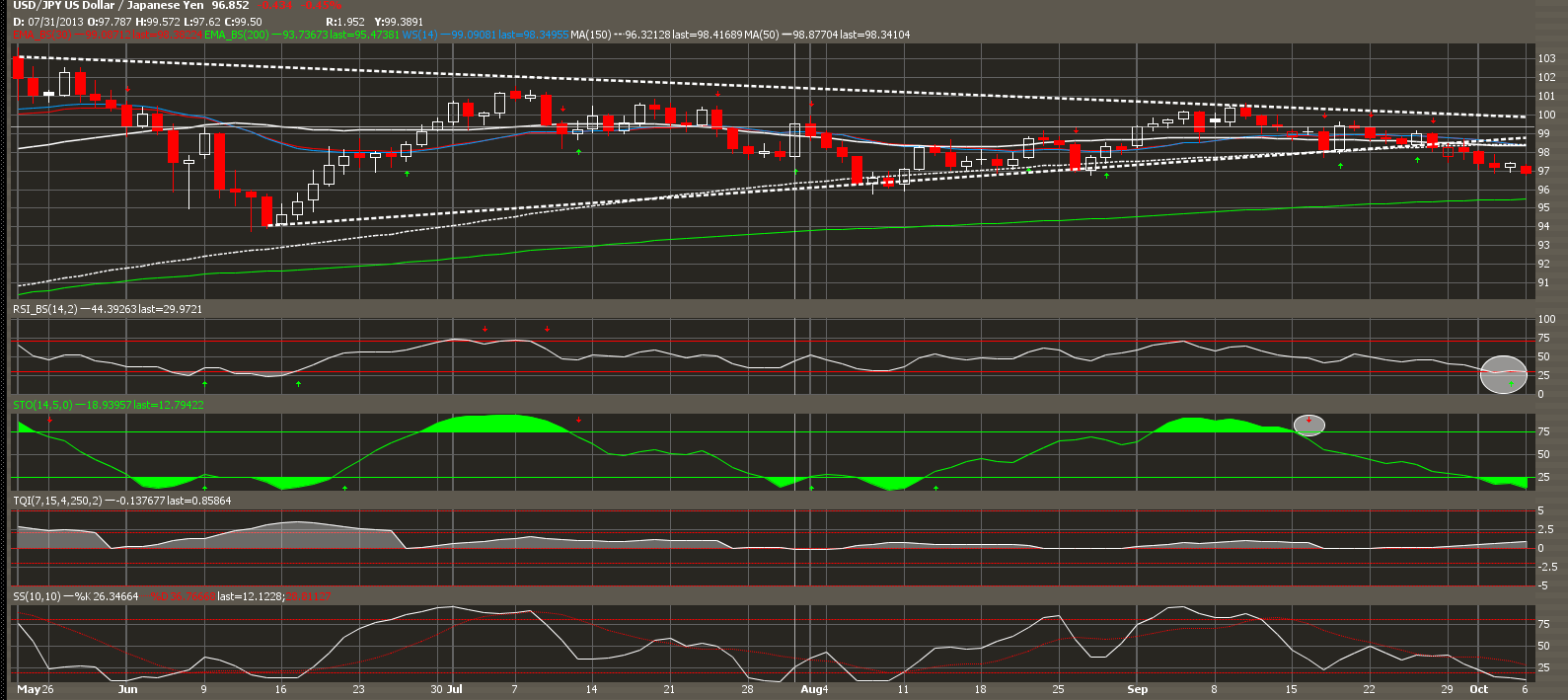

Between the Macro events occurring, and the Technicals, the pain trade seems to be lower for the US Dollar. The only bull case I could think of at the moment is that it seems that the sell the dollar trade is starting to get extremely heavy, triggering a short-term reversal. Until then, I am looking for support levels and continued sell points.

In September, I noted the 97.50 level being important support, of which this level was broken on 10/2. 97.50 was important for several reasons, one being 50% Fibonacci support. We have broken this Fibonacci level a few times since May, all of which did not pan out too well. In August, this led to support at 96.18, and in June, led to 78.6% or 94.30. I would use these too levels for buy/sell triggers. To either get long if we hold, or press down the short if we break lower. Also, if short, look to 97.50 as your stop/resistance level.

Looking more into the internals of the trend, MACD is on a continued downtrend. This trend started right at the top of the August-September rally at 100.50, and marked the sell-off perfectly. Currently, looks like MACD will continue down to its first support level at -62. This level also marked a mid-term bottom in the pair at 96. Relative Strength is also on a major downtrend, similar to the MACD performance. There is some support near current levels at 36.50, and will be an extremely important test for the buyers to either come back in, or sellers to continue their hold and take the USDJPY pair lower.

Digging further into the Technicals, Stochastics and Slow Stochastics are both showing oversold levels, but showing this trend to continue, with no reversal, or “Buy” signal in site. There is longer term support in the 200 Day around 95.50, and looks like at least these two stochastic indicators are pointing towards continued selling to these levels. Relative strength, on the other hand, matches that support level shown in the first Chart, and here you can see a possible reversal (or hold) in trend, starting to show buy signals.

The pair needs to regain the 99 level to get back to its mid-term uptrend, or hold below Par to continue the uptrend in the Yen. Support levels to look out for, in the sense of making solid lower lows, 96.25 from August, and 94 from June.

(Full Disclosure: Currently no position in the pair either way, but looking to trade the US Dollar and the Pair on a shorter-term Technical basis via #FVAM)